OG21 Strategy - A New Chapter

Publisert 15. sep. 2021

Summary with recommendations

- The energy transition brings about a new chapter for petroleum and the NCS

A growing global population, expected to reach 9.7 billion people by 2050, needs access to affordable and sufficient energy, food, clean water, and sanitation. Petroleum has historically been important to address such challenges. However, the production and use of petroleum also causes greenhouse gas (GHG) emissions. Moving forward, GHG emissions will have to be reduced, which will require collaboration and concerted efforts.

Demand for oil and gas declined in 2020 as a result of the Covid-19 pandemic. The demand has since recovered, and oil and gas prices are by October 2021 much higher than before the pandemic. A continued high demand is expected over the next years, but the long-term outlook is uncertain. The Norwegian petroleum industry needs to be prepared for tighter markets, lower prices, and higher volatility. In such an energy future, the competition will increase, not only for oil and gas market shares, but also for talent and investments.

In OG21's opinion, oil and gas producers that can deliver petroleum at low costs, with low GHG emissions, and with accept and support from stakeholders, are likely to outcompete their peers. Stakeholder accept and support hinges on the ability to reduce GHG emissions, achieve excellent safety results, and deliver competitive returns.

- Norway is a global leader in petroleum technology, but innovation is required to maintain our competitive edge

The Norwegian Continental Shelf (NCS) is well positioned to stay competitive in an energy landscape under transition where the battle for market shares, talent and investments could become more intense. The NCS is characterized by:

- attractive and stable frame conditions,

- a safe and very cost-efficient infrastructure which will continue to produce existing reserves as well as new oil and gas resources,

- a promising discovery portfolio with resources that could be tied back to and produced through the existing infrastructure,

- attractive acreage close to existing infrastructure

- world leading environmental performance, including among the lowest GHG emissions per barrel produced,

- a well-respected safety collaboration between regulators, employers and employees which has resulted in world leading safety standards and emission results.

Research, development, and innovation (R&D&I) is critical for maintaining the competitive edge:

New technology and knowledge, and the ability to adopt technology and knowledge fast, will be instrumental in keeping costs down, reduce CO2-emissions and continually improve safety. OG21 is of the opinion that research, technology development, and innovation within 8 technology areas are especially important (details on technology and knowledge priorities in section 4 of this report):

- Improved subsurface understanding and tools are fundamental for the attractivity and competitiveness of the NCS. The technology area has important ties to all disciplines: it will improve identification of opportunities and exploration for resources; improve well positioning and aid in the completion of wells; improve drainage of reservoirs; reduce water production which is the main contributor to energy use and GHG emissions on the NCS installations; and reduce safety risks associated with drilling. It is also fundamental for efficient carbon capture and storage (CCS).

- Cost-efficient drilling and P&A address two major cost elements of offshore operations. More cost-efficient drilling requires improved methodologies and tools for well construction, more efficient drilling technologies for subsea wells, improved completion solutions, and better subsea well intervention technologies. In addition to reducing costs, such methodologies and tools could also reduce emissions and improve recovery from challenging reservoirs. Plugging and abandonment of wells (P&A) represents a potential high future cost for oil companies and the Norwegian state, and it is a pressing need for development and application of significantly more cost-efficient technologies.

- Utilizing existing infrastructure efficiently will be key to produce remaining reserves in the fields and to realize contingent resources. Contingent resources could be in fields, in the NCS discovery portfolio, and in new near-field discoveries. Existing infrastructure should also be evaluated for re-purposing when approaching end of production, for instance for late-life deposits of CO2 in relation to CCS. The technology area includes technologies and knowledge for process optimization and integrity management, for instance: improved process simulators, condition-based monitoring, risk-based maintenance and improved understanding of materials and material degradation mechanisms.

- Unmanned facilities and subsea tie-back solutions include technologies such as flow assurance models to extend the possible tie-back distances, subsea processing technologies and unmanned production facilities.

- Energy efficiency and cost-efficient electrification are of paramount importance to meet the industry's ambitious GHG emission target of 50% reduction by 2030. Electrification from shore and use of offshore renewables are the most important technologies to reduce operational GHG emissions. There are many costly technical challenges to be solved such as power transfer through FPSO turrets, subsea HVDC converters and long-range AC transmission. Electrification hubs and large grid systems could also reduce costs. Energy efficiency can be improved for instance with technologies to reduce water production, water processing downhole or subsea, combined cycle gas turbines, and the use of low carbon fuels in gas turbines.

- Carbon capture and storage (CCS) is a key technology area to reduce CO2-emissions. Firstly, CCS provides an opportunity to de-carbonize natural gas either onshore or offshore (gas-to-X where X could be either blue hydrogen or electrical power). Secondly, an opportunity to apply CCS directly to offshore gas turbines to reduce operational emissions, should be explored. In addition, CCS represents an industrial opportunity for broad multi-industry application.

- World leading HSE and environmental performance is a fundamental value for the industry and a pre-requisite for society acceptance. It includes improved knowledge to understand and mitigate risks related to adoption of new technologies and new business models, better tools for understanding major accident risks and uncertainties, improved management of cyber security risks, and the continual effort to understand and reduce working environment risks.

- Digitalization spans across all disciplines. The technology area is fundamental for improved and faster decision processes, which will reduce costs, increase the resource base, reduce GHG emissions and improve safety. The development and application of new tools and solutions such as artificial intelligence, robotics and drones, and digital twins, are key to achieve a digital transformation of the industry. To get there, there is a need for acquiring and processing data more efficiently, a need for more collaboration on data access, data formats and data quality, and a need to change work processes and business models to fully utilize the potential of new technology.

Several factors may inhibit R&D&I that could benefit industry enterprises as well as the society. For example, it might be more attractive to be an early adopter rather than the developer of technology, individual enterprises might alone have a limited application scope of new technology whereas the application scope aggregated across a group of enterprises could be large, and some technologies could have important societal benefits whereas business impact is uncertain or low. Industry collaboration as well as public R&D&I incentives, are required to address such R&D&I challenges.

- Our industrial heritage and world-leading technology and competence could be the steppingstone to new industrial ventures

The Norwegian petroleum industry's contributions to the energy transition and a zero-emission society include three elements:

- De-carbonatization of the petroleum production phase as described in Konkraft's roadmap (Konkraft, 2020), (Konkraft,2021), see Section 3.

- De-carbonization of petroleum value chains, which in addition to abating CO2-emissions, also could contribute to securing the future market for natural gas.

- Participation in and transfer of competence and solutions to emerging low-carbon industries.Just as the Norwegian petroleum industry once was built on competence and skills from the maritime industries, Norway is now well positioned to take a leading role in emerging industries where our world leading petroleum competencies and solutions will provide a competitive edge.

Just as the Norwegian petroleum industry once was built on competence and skills from the maritime industries, Norway is now well positioned to take a leading role in emerging industries where our world leading petroleum competencies and solutions will provide a competitive edge.

Currently, half of the Norwegian petroleum production is natural gas, and it is expected to stay at this level for the next decade. Nearly all the natural gas is exported to EU countries and the UK where it could continue to replace coal and thus reduce CO2-emissions. Nevertheless, the industry needs to be prepared for a possibly reduced future demand for natural gas because of the EU Green Deal. To secure the market for natural gas in the longer term, the gas can be de-carbonized, either into blue hydrogen and hydrogen-derived fuels like ammonia, or into low-emission electrical energy.

CCS is a key technology in this transition. Competence and solutions from the petroleum industry are essential for safe and lasting storage of CO2, e.g. to understand the geology where the CO2 is sequestered, possible migration paths, as well as monitoring for leaks. In addition to enabling continued sales of natural gas, CCS also represents a wider industry opportunity for de-carbonizing other industries with high CO2-emissions such as cement production and steel production. The Longship project to demonstrate the CCS value chain is therefore very important. We need continued research and innovation to broaden the industry scope for CCS and to make CCS value chains more cost-efficient.

Hydrogen and hydrogen-derived fuels produced from natural gas in combination with CCS is also an industrial opportunity for Norway. Traditionally, hydrogen and ammonia have been used in some industrial processes, but the potential application scope is a lot bigger. Hydrogen could be used as the reducing agent in steel production; as an energy carrier for heating of buildings; as a fuel in electricity generation; and as a transportation fuel. Common for all such new application areas is that new value chains need to be established and demonstrated.

Floating offshore wind energy is still in the demonstration phase, but it represents a great opportunity for Norwegian suppliers and energy companies. In addition to provide electricity to the onshore energy system, offshore floating wind could also produce clean energy for the NCS petroleum activities. Examples of transferable world-class petroleum competence and solutions that could provide a competitive advantage, include: Offshore floating structures; offshore dynamics; mooring and positioning; offshore power connectors and transmission; condition monitoring and maintenance; and robotics and automation.

Marine minerals mining is still in a very early conceptual stage. There are potentially large volumes of minerals at the mid oceanic ridge, which could contribute to meeting a rising demand for minerals. Many challenges need to be solved before seabed mining is realized, e.g.: deep sea mining equipment must be developed; logistics need to be solved; and environmental risks need to be understood, mitigated, and managed. All such challenges resemble challenges the Norwegian petroleum industry is used to handling.

Development of new industries that could contribute to the energy transition, should take place in parallel with the further development of the petroleum industry so that synergies could be leveraged.

- Sufficient technology development and uptake will require leadership, new talent as well as broad collaboration in a well-functioning innovation system

To stimulate the required innovation, OG21 believes three elements are critical:

A. We need to attract and develop talent. The petroleum industry is approaching "the great crew change". A high portion of the employees will retire over the next decade, and experience and domain knowledge could be lost. New technology, especially advanced digital technologies, will require new competencies and skills.

Two competence areas could become especially important to maintain the innovation capability:

I. Attracting new graduates by offering exciting and meaningful jobs and by convincing them through tangible results that the industry takes climate change seriously.

II. Training and developing the existing workforce to understand, develop and adopt new technologies.

B. The efficient innovation system in Norway needs to be maintained and further developed.

I. The close collaboration between industry, research institutes and universities, stimulated by government funding and tax incentives, has been a successful recipe for the petroleum sector. It needs to continue.

II. Governmental R&D funding for the petroleum sector needs should reflect the technology priorities of this OG21 strategy. R&D strengthens the competitiveness of the NCS, and includes R&D aimed at reducing GHG emissions as well as R&D for more cost-efficient petroleum resource utilization. The high portion of high-quality R&D projects that fails in the competition to obtain governmental funding, in combination with the many challenges the industry is facing, clearly shows that petroleum R&D is under-funded. Governmental funding of petroleum R&D should therefore be increased.

III. Petroleum research programs should encourage cross-discipline R&D, including system perspectives, so that the value of new technologies and how technologies depend on system integration, becomes more apparent. More collaboration across disciplines such as science, engineering, technology, mathematics, and social sciences should be encouraged. The RCN should evaluate new and more agile approaches to R&D funding to complement the current system and identify for what types of projects and calls such approaches could be applied.

IV. The established sectoral approach to R&D is important as it draws attention to specific R&D challenges within an industry and facilitates alignment between industry, academia and the government on objectives and priorities. It does, however, come with some drawbacks. It lacks a high-level agenda setting mechanism and mechanisms for holistic coordination and management. OG21 therefore supports the idea of supplementing the well-established and efficient sectoral approach to R&D&I, with cross-sectoral "missions" to guide R&D&I efforts on societal challenges reaching across sectors.

C. We need visible and consistent technology leadership at executive level:

I. Industry enterprises need to have visible “technology champions” at the executive level that provide consistent signals on the need for technology to maintain competitiveness, and which have the willingness and stamina to develop, test and improve technology. The responsibility for technology should start at the executive level and be distributed throughout the organization. The responsibility should be reinforced through key performance indicators and incentives.

II. The larger oil companies need to have a portfolio rather than a project approach to new technology. Petoro should advocate for technology collaboration across the wide range of production licenses they are involved in. The NPD and the PSA should leverage their influence on technology development and adoption in the production licenses.

III. Executive level technology managers should make sure that technology opportunities are identified and communicated to potential technology suppliers early so that suppliers have a possibility to suggest and develop new value-creating technology in time.

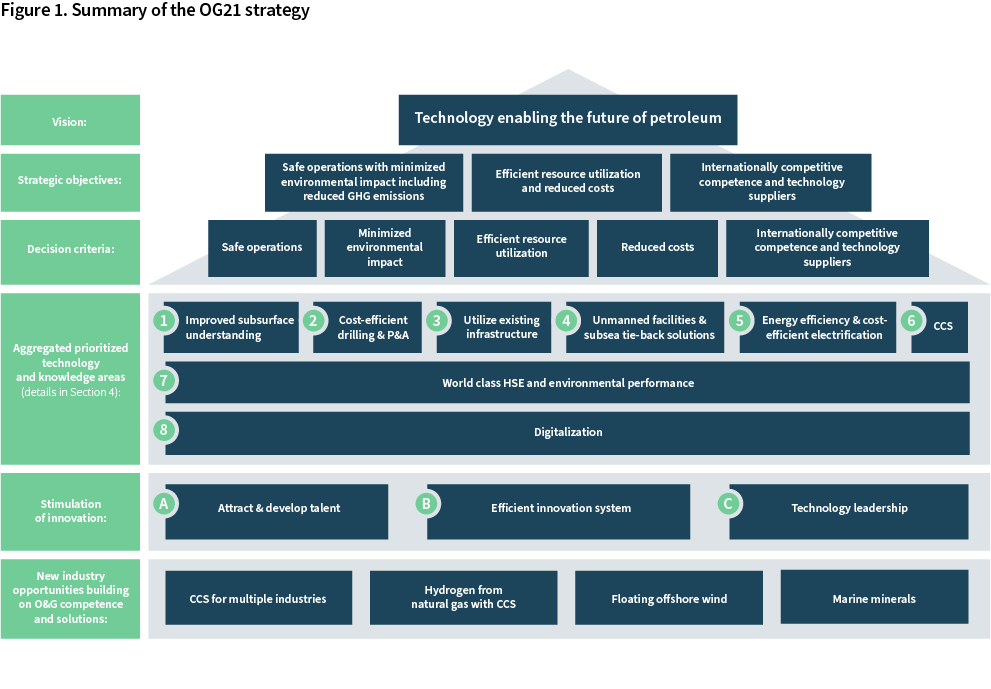

The new OG21 strategy is summarized in Figure 1.

Meldinger ved utskriftstidspunkt 6. juli 2025, kl. 05.32 CEST