OG21 Strategy - A New Chapter

Publisert 19. okt. 2021

Technology and knowledge needs

Overview of technology priorities for all disciplines

The overarching goal of technology development and implementation is to realize value from the NCS safely and with minimal environmental impact.

The OG21's technology groups (TGs) have identified new technology and competence that could improve the NCS competitiveness in light of the future demand for oil and gas described in Section 2 and the challenges and opportunities described in Section 3.

A total of 30 technology and knowledge areas have been prioritized. In addition, the TGs have discussed and identified opportunities for new industry development based on the competence and solutions in the petroleum industry as well as opportunities for improved life-cycle management and circular economy.

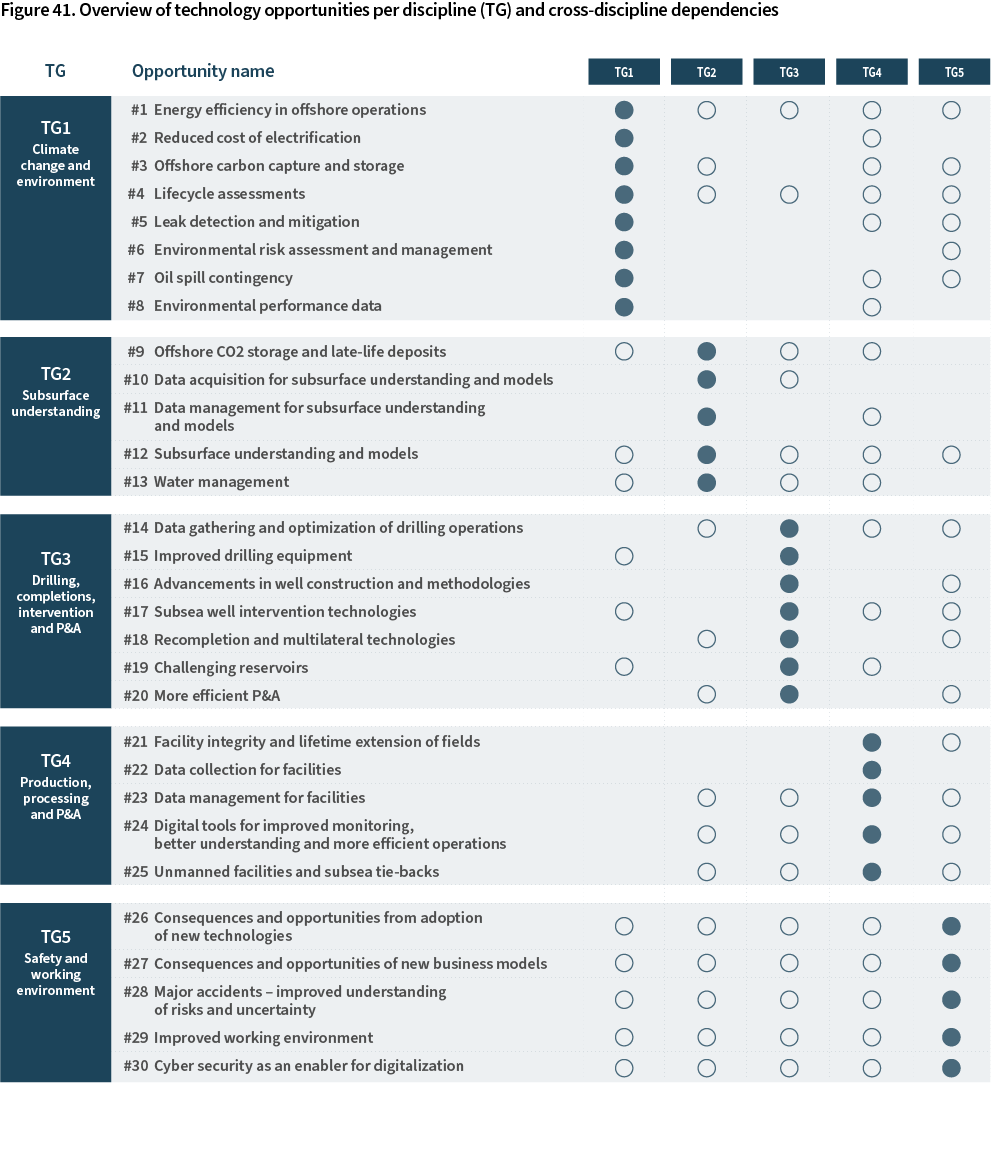

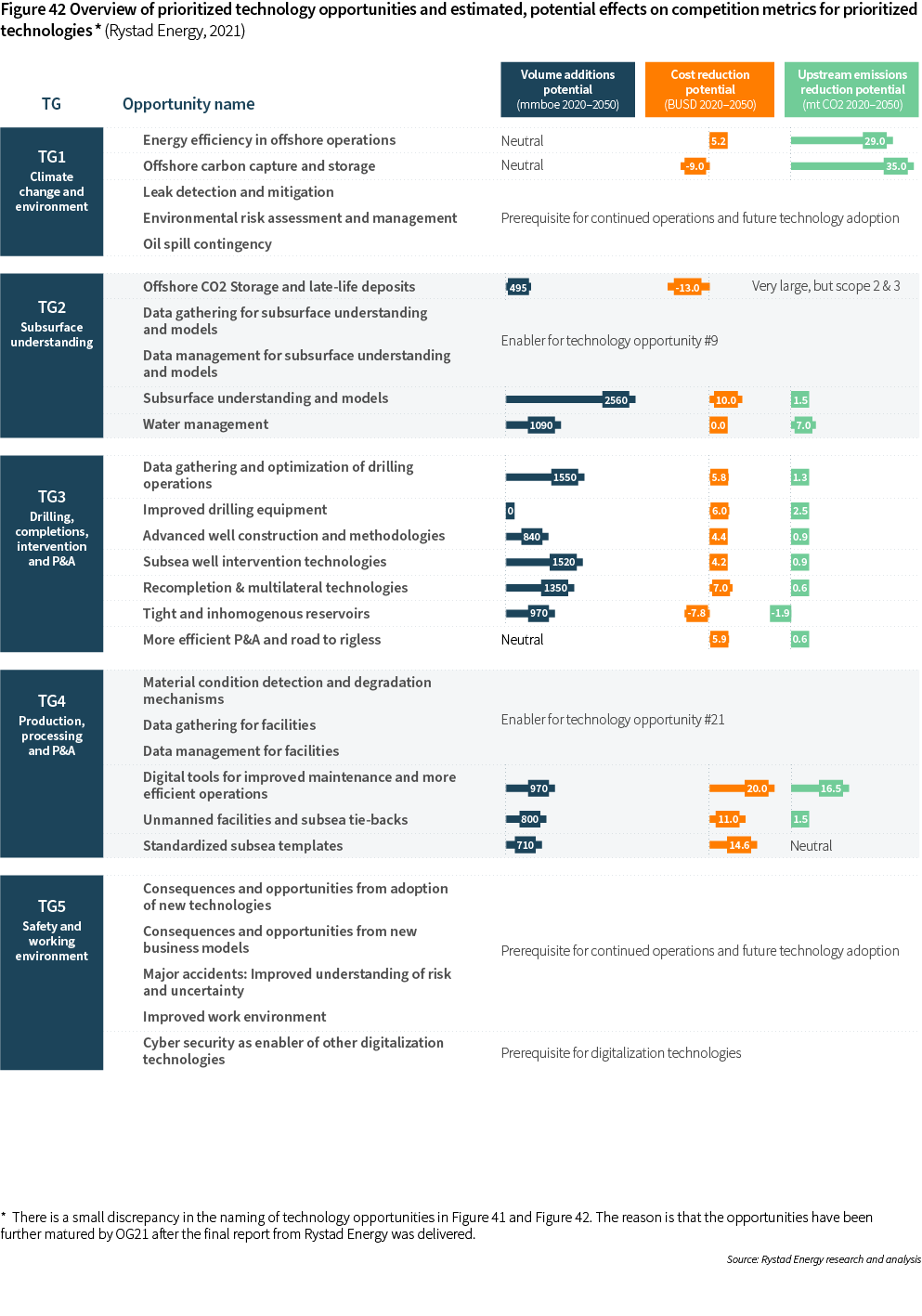

An overview of the technology priorities per discipline (TG) and interconnections between disciplines, is shown in Figure 41. Estimates on potential value for technology opportunities is presented in Figure 42. A detailed description of the prioritized technology areas for each TG is provided in the following sub-sections.

As Figure 41 indicates, a broad range of technologies is needed to improve the NCS competitiveness. Each prioritized technology area offers significant improvements on at least one of the competition metrics. Combined, the prioritized technology areas hold a promise of improving the NCS competitiveness along all metrics, including volumes, costs, and CO2-emissions.

The prioritized safety and environment technology areas are fundamental for the "license-to-operate". Addressing the technology and knowledge needs within these areas is therefore of vital importance for the further development of the NCS.

Stakeholders in the petroleum sector have a shared responsibility for addressing the technology priorities through R&D&I, and OG21 therefore encourage industry enterprises, universities, research institutes as well as public funding bodies, to reflect OG21 priorities in their R&D&I plans and programs.

We have not indicated current TRL-level for the prioritized areas. The reason is that even for prioritized areas where mature technologies exist in the market, there is still scope for radical new innovations, new components or new knowledge that could replace or improve existing solutions.

Safety and working environment

The NCS and the Norwegian petroleum industry compete in global markets. To stay competitive the industry needs to become more cost-efficient, successfully explore and develop new resources, reduce lead times, and significantly reduce GHG emissions as discussed in Section 3. But at the same time, a high safety level must be achieved to maintain support in the society.

The strive for improved competitiveness for a maturing oil province as the NCS introduces safety risks that must be managed, e.g.:

- An aging infrastructure which requires more inspection and maintenance.

- New inspection and maintenance philosophies and technologies.

- New digital technologies like remote operations and autonomy.

- New low-carbon technologies and energy carriers like hydrogen and ammonia.

- A changing operator landscape with fewer large international companies and more medium sized and small independent oil companies.

- New business models and contract models where contractors and suppliers are integrated with operators.

- Increased integration of digital systems and technologies that could render the systems more vulnerable to cyber security threats.

These risks have been the considered when TG5 has prioritized technology and knowledge areas. The prioritized technology and knowledge areas for TG5 are:

- Consequences and opportunities from adoption of new technologies.

- Consequences and opportunities of new business models.

- Major accidents: Improved understanding of risks and uncertainty.

- Improved working environment.

- Cyber security as an enabler for digitalization.

An important principle on the NCS is that changes shall provide at least the same level of safety as prior to the changes. Understanding the safety and working environment consequences of introducing new technology is hence important. We need an improved understanding as well as improved safety risk management of the potential safety and working environment hazards of all types of new technologies being considered for implementation. This includes the technology needs identified by the other OG21 Technology Groups.

The same principle also applies to organizational and structural changes. It is therefore important to improve the understanding of how the changing NCS operator landscape as well as new collaboration models such as strategic alliances between operators, suppliers, and service providers, influence safety and the working environment.

Petroleum operations involve safety risks. The industry works continuously to identify hazards, and understand, reduce, and mitigate risks. To improve, the industry needs to further develop the understanding of risks including how to manage the inherent uncertainty that risks are associated with. This particularly applies to major accident risks. Improvement areas include for instance better integration of human factors in risk management tools, and improved systems for learning from the past.

The precautionary principle should be applied when the consequences of activities are uncertain or unknown. There is a continued need to better understand the physical, chemical, social, or the psychological work environment of ongoing activities. Likewise, such working environment factors should be investigated also when new technology and new work processes are implemented.

The cyber-security area addresses an imminent and rapidly increasing threat to the industry. The industry is progressively making use of digital solutions in numerous new areas. As new digital technologies are implemented and industrial operational systems are becoming more integrated with other information technology systems in enterprises, the design and management of barriers becomes more complex. There is a need to better understand safety implications of new infrastructure complexities and threats, as well as the vulnerability of data and applications. Furthermore, it's important to strengthen the national cyber security competence and the situational awareness on such issues in the Norwegian petroleum industry. The industry is dependent upon a digital transformation to stay competitive, and managing cyber-security threats efficiently, is fundamental to this transformation. In this context it should also be noted that improved management of information and communication technology (ICT) security has a potential large transfer value to other disciplines.

Environment and greenhouse gas emissions

The prioritized technology and knowledge areas for TG1 are:

- Energy efficiency in offshore operations.

- Reduced cost of electrification.

- Offshore carbon capture, utilization and storage (CCUS).

- Lifecycle assessments.

- Leak detection and mitigation.

- Environmental risk assessment and management.

- Oil spill contingency.

- Environmental performance data.

The first three are addressing the need for reducing CO2-emissions from the NCS, described in Section 3.3; whereas lifecycle assessments look at assessing environmental impacts beyond the NCS geography (supply chain etc.). The next three are related to the “zero harm” vision and drive for continual improvement described in Section 3.1 and 3.2. The final point looks at the coverage of and access to data which describes environmental performance.

Technology development includes development of knowledge. The technology strategy emphasizes the need for improved knowledge, improved risk understanding, and corresponding mitigating actions to ensure a sustainable effect on the environment from the oil and gas activities.

Implementation of new technologies might affect risk. Technology development within the environment and greenhouse gas emission perspectives will need to consider its possible impact on safety by ensuring an integrated risk assessment of possible technology solutions.

Subsurface understanding

The prioritized technology and knowledge areas for TG2 are:

- Offshore CO2 storage and late life deposits.

- Data acquisition for subsurface understanding and models.

- Data management for subsurface understanding and models.

- Subsurface understanding and models.

- Water management.

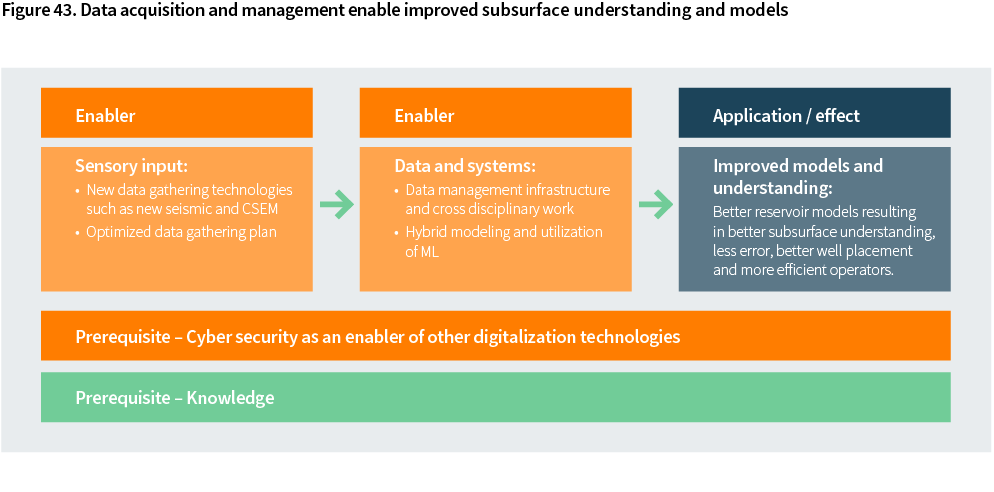

The "data acquisition" and "data management" technology areas, described in detail on the next pages, are enablers for the "subsurface understanding and models" technology area. This is shown in the figure below.

The TG2-prioritized technology areas are important for all the competition indicators described in Section 3.

For instance, the improved subsurface understanding and models, building on data acquisition and the management related to it, will provide the fundament for:

- Finding and maturing new resources.

- Cost-efficient reservoir drainage.

- Safe and cost-efficient drilling.

Offshore CO2 storage has, in addition to receive and store large amounts of CO2 from industry sources in Norway and abroad, the potential to extend the lifetime of fields beyond the cessation of O&G production.

Improved water management will lead to significant reductions in water cycling, and thereby lower emissions from power generation. It is also expected that improved water management will accelerate HC production and yield higher resources by a more efficient reservoir drainage, as well as savings related to less energy consumption for processing of both injection and produced water.

Drilling, completions, intervention, and P&A

Although drilling performance has improved substantially over the last 6 years, Drilling & Wells is still the main cost element on the NCS, representing 28% of estimated expenditures on the NCS for the 2021-2040 time period (Rystad Energy, 2021).

The prioritized technology and knowledge areas for TG3 are:

- Data gathering and optimization of drilling operations.

- Improved drilling equipment.

- Advanced well construction and methodologies.

- Subsea well intervention technologies.

- Recompletion and multilateral technologies.

- Challenging reservoirs.

- More efficient P&A.

All TG3-priorities have the potential to cut costs on the NCS significantly (see Figure 42). In addition, most would contribute to adding significant volumes. Most of the priorities would also have a potential positive impact on CO2-emissions.

"Challenging reservoirs" are with current technologies associated with higher CO2-emissions than conventional reservoirs. Considering the large volumes on the NCS in such reservoirs, the R&D efforts should be aimed at reducing CO2-emission to at least the same level as for conventional reservoirs. We believe such reservoirs could potentially be drained with technologies that are not necessarily very energy consuming, e.g. more mechanical technologies can be developed, and fluid pumping methods could be advanced.

Common for most of the evaluated TG3 priorities is that they can be adopted fast – often they would yield saved costs or added volumes within a year from investment decision. This make such technologies especially attractive in a business environment where fast returns are favored and may explain why such technologies had a relatively high adoption rate during the petroleum recession period 2014-2018.

We have seen some technology development for rig equipment over the last years, but there is still scope for further improvements. Making use of sensor data and Artificial Intelligence (AI) to improve automation and make the rig operate more towards optimum performance every time, will improve the efficiency and as such minimize the carbon footprint of the operation. This combined with improved and modernized drilling equipment has a considerable potential.

When it comes to well construction, new drilling methods and optimized well design combined with intelligent utilization of existing wells have been demonstrated by some of the operators on the NCS. There are however several new technologies where the full potential is still not harvested. Further development and adoption of such technologies could reduce the number of days per well, and facilitate cost and volume optimized wells, i.e. maximizing the value of each well.

P&A of wells on the NCS is a considerable challenge ahead. We need step change technologies to make these operations as effective as possible to minimize future expenditures. The market volume is increasing, and several service companies are very creative in this arena and should be stimulated to advance these technologies to minimize rig days, emissions, and costs.

Production, processing, and transport

Remaining contingent resources on NCS as presented in Figure 2, are almost equally distributed between contingent resources in existing fields and contingent resources in the NCS discovery portfolio. Average size of discoveries is decreasing, but most discoveries are within tie-back distance to existing fields, as shown in Figure 29.

The NCS is characterized by very efficient infrastructure which is the main reason behind favorable operational costs and break-even prices presented in Figure 32 and Figure 33. However, as production declines from existing fields, costs per barrel increase unless more resources are produced.

Cost-efficient continued development of the NCS is therefore dependent upon two success factors in particular:

- Efficient utilization of the existing infrastructure to realize contingent resources in the areas.

- Realization of discoveries through tie-backs to existing infrastructure.

Making a step-change in cost effectiveness for subsea solutions will enhance tie-in economy and hence provide a great impact on the ability to lift additional volumes from near-field discoveries and prospects. With the high number of potential tie-in projects going forward, there is a great advantage to standardize on new subsea technologies to enable wide implementation with reduced unit costs.

Safe lifetime extension of existing installations is contingent on cost-effective documentation of present state with adequate quality. In this context, efficient development and implementation of sensors and tools, both physical and software, is important across NCS. Robotics with increased level of autonomy and advanced analytics including Artificial Intelligence can prove vital tools for documentation of condition, but also safe and efficient production while in operation.

Value of data is realized when used to update a risk picture, integrate into optimization schemes, or inform decisions to be made. Further, efficient data-collection will bring most value when systemized and coupled with domain knowledge on e.g. degradation mechanisms and prediction of future load and response. Such knowledge on both capacity and load side of offshore structures is important. Technologies improving management of information across all project development interfaces (research communities, contractors, suppliers, service providers, partners, manufacturers, integrator) is needed to improve efficiency in engineering, construction, operation/maintenance. This calls for standardized digital twin solutions.

Extent of modification scope needed on existing infrastructure to accommodate tie-backs is important for viability of new tie-in prospects. Swift modification and hook-up are important also for production efficiency of the existing production. Ability to choose subsea processing technology may ease topside modification scope, reduce cost and project execution time and thereby enhance overall economy of such projects. Several subsea processing technologies matured to project ready level is hence needed to capitalize on these opportunities.

For long tie-back distances, multiphase flow technology development competes with subsea processing and unmanned installations to provide the best development solution for a given prospect. Use of unmanned installations, floating or fixed, will increase the ability to process well stream to transport quality. Using existing infrastructure onshore as well as offshore for further processing can prove cost efficient. Further development of unmanned systems needed to improve brownfield as well as open greenfield opportunities is essential to harvest the full potential and define the NCS petroleum future.

The prioritized technology and knowledge areas for TG4 are closely linked to the success factors. The TG4 priorities are:

- Material condition detection and degradation mechanisms.

- Digital sensory and technologies for facilities.

- Data management for facilities.

- Digital tools for improved monitoring and better understanding.

- Unmanned facilities and subsea processing.

- Standardized subsea templates.

Meldinger ved utskriftstidspunkt 7. juni 2025, kl. 11.47 CEST