OG21 Strategy - A New Chapter

OG21 Strategy - A New Chapter

ISBN: 978-82-12-03907-0 ( Webversjon ) – OG21 – A new chapter

Executive summary

Background and purpose

OG21 has its mandate from the Norwegian Ministry of Petroleum and Energy (MPE). The purpose of OG21 is described in the mandate: “OG21 will contribute to efficient, safe, and environmentally friendly value creation from the Norwegian oil and gas resources. This will be achieved through a coordinated engagement of the Norwegian petroleum cluster within education, research, development, demonstration, and commercialization. OG21 will inspire to development and adoption of new and better knowledge and technology, aligned with an energy system under transition and the goal of reduced greenhouse gas emissions".

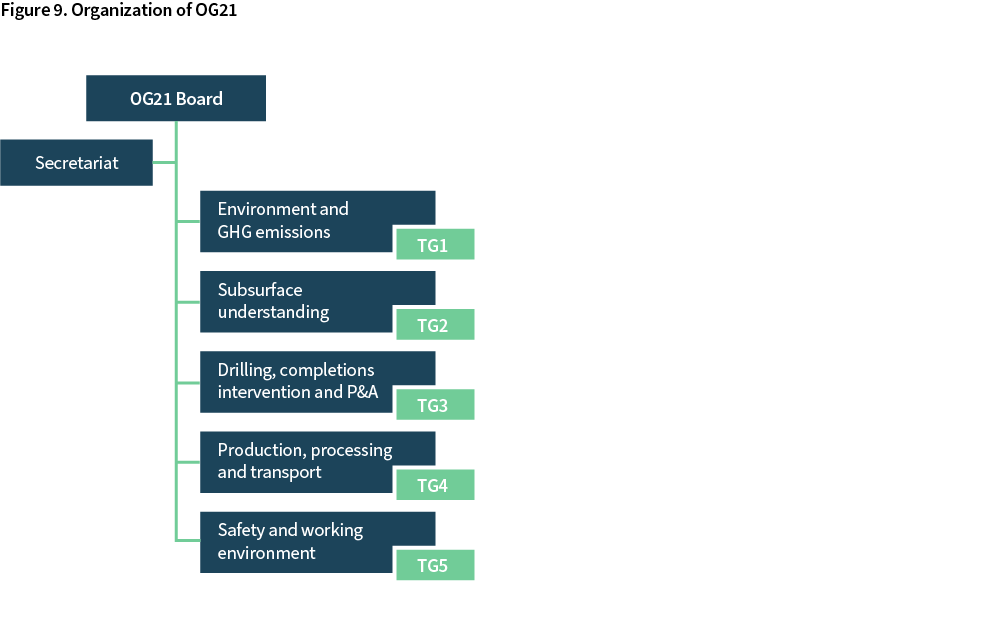

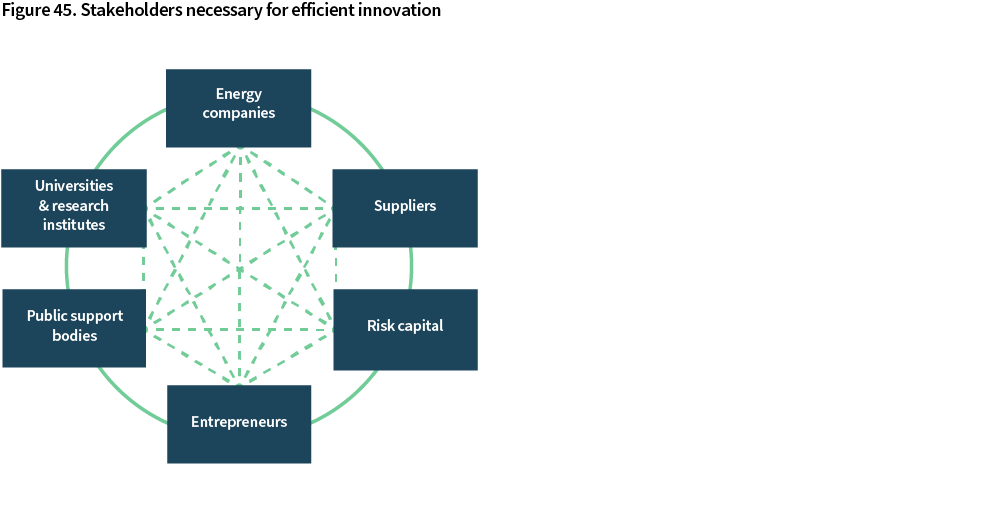

OG21 brings together oil companies, universities, research institutes, suppliers, regulators, and public bodies to develop and maintain a national petroleum technology strategy for Norway.

The strategy is written in English with the Executive Summary translated into Norwegian.

Summary with recommendations

- The energy transition brings about a new chapter for petroleum and the NCS

A growing global population, expected to reach 9.7 billion people by 2050, needs access to affordable and sufficient energy, food, clean water, and sanitation. Petroleum has historically been important to address such challenges. However, the production and use of petroleum also causes greenhouse gas (GHG) emissions. Moving forward, GHG emissions will have to be reduced, which will require collaboration and concerted efforts.

Demand for oil and gas declined in 2020 as a result of the Covid-19 pandemic. The demand has since recovered, and oil and gas prices are by October 2021 much higher than before the pandemic. A continued high demand is expected over the next years, but the long-term outlook is uncertain. The Norwegian petroleum industry needs to be prepared for tighter markets, lower prices, and higher volatility. In such an energy future, the competition will increase, not only for oil and gas market shares, but also for talent and investments.

In OG21's opinion, oil and gas producers that can deliver petroleum at low costs, with low GHG emissions, and with accept and support from stakeholders, are likely to outcompete their peers. Stakeholder accept and support hinges on the ability to reduce GHG emissions, achieve excellent safety results, and deliver competitive returns.

- Norway is a global leader in petroleum technology, but innovation is required to maintain our competitive edge

The Norwegian Continental Shelf (NCS) is well positioned to stay competitive in an energy landscape under transition where the battle for market shares, talent and investments could become more intense. The NCS is characterized by:

- attractive and stable frame conditions,

- a safe and very cost-efficient infrastructure which will continue to produce existing reserves as well as new oil and gas resources,

- a promising discovery portfolio with resources that could be tied back to and produced through the existing infrastructure,

- attractive acreage close to existing infrastructure

- world leading environmental performance, including among the lowest GHG emissions per barrel produced,

- a well-respected safety collaboration between regulators, employers and employees which has resulted in world leading safety standards and emission results.

Research, development, and innovation (R&D&I) is critical for maintaining the competitive edge:

New technology and knowledge, and the ability to adopt technology and knowledge fast, will be instrumental in keeping costs down, reduce CO2-emissions and continually improve safety. OG21 is of the opinion that research, technology development, and innovation within 8 technology areas are especially important (details on technology and knowledge priorities in section 4 of this report):

- Improved subsurface understanding and tools are fundamental for the attractivity and competitiveness of the NCS. The technology area has important ties to all disciplines: it will improve identification of opportunities and exploration for resources; improve well positioning and aid in the completion of wells; improve drainage of reservoirs; reduce water production which is the main contributor to energy use and GHG emissions on the NCS installations; and reduce safety risks associated with drilling. It is also fundamental for efficient carbon capture and storage (CCS).

- Cost-efficient drilling and P&A address two major cost elements of offshore operations. More cost-efficient drilling requires improved methodologies and tools for well construction, more efficient drilling technologies for subsea wells, improved completion solutions, and better subsea well intervention technologies. In addition to reducing costs, such methodologies and tools could also reduce emissions and improve recovery from challenging reservoirs. Plugging and abandonment of wells (P&A) represents a potential high future cost for oil companies and the Norwegian state, and it is a pressing need for development and application of significantly more cost-efficient technologies.

- Utilizing existing infrastructure efficiently will be key to produce remaining reserves in the fields and to realize contingent resources. Contingent resources could be in fields, in the NCS discovery portfolio, and in new near-field discoveries. Existing infrastructure should also be evaluated for re-purposing when approaching end of production, for instance for late-life deposits of CO2 in relation to CCS. The technology area includes technologies and knowledge for process optimization and integrity management, for instance: improved process simulators, condition-based monitoring, risk-based maintenance and improved understanding of materials and material degradation mechanisms.

- Unmanned facilities and subsea tie-back solutions include technologies such as flow assurance models to extend the possible tie-back distances, subsea processing technologies and unmanned production facilities.

- Energy efficiency and cost-efficient electrification are of paramount importance to meet the industry's ambitious GHG emission target of 50% reduction by 2030. Electrification from shore and use of offshore renewables are the most important technologies to reduce operational GHG emissions. There are many costly technical challenges to be solved such as power transfer through FPSO turrets, subsea HVDC converters and long-range AC transmission. Electrification hubs and large grid systems could also reduce costs. Energy efficiency can be improved for instance with technologies to reduce water production, water processing downhole or subsea, combined cycle gas turbines, and the use of low carbon fuels in gas turbines.

- Carbon capture and storage (CCS) is a key technology area to reduce CO2-emissions. Firstly, CCS provides an opportunity to de-carbonize natural gas either onshore or offshore (gas-to-X where X could be either blue hydrogen or electrical power). Secondly, an opportunity to apply CCS directly to offshore gas turbines to reduce operational emissions, should be explored. In addition, CCS represents an industrial opportunity for broad multi-industry application.

- World leading HSE and environmental performance is a fundamental value for the industry and a pre-requisite for society acceptance. It includes improved knowledge to understand and mitigate risks related to adoption of new technologies and new business models, better tools for understanding major accident risks and uncertainties, improved management of cyber security risks, and the continual effort to understand and reduce working environment risks.

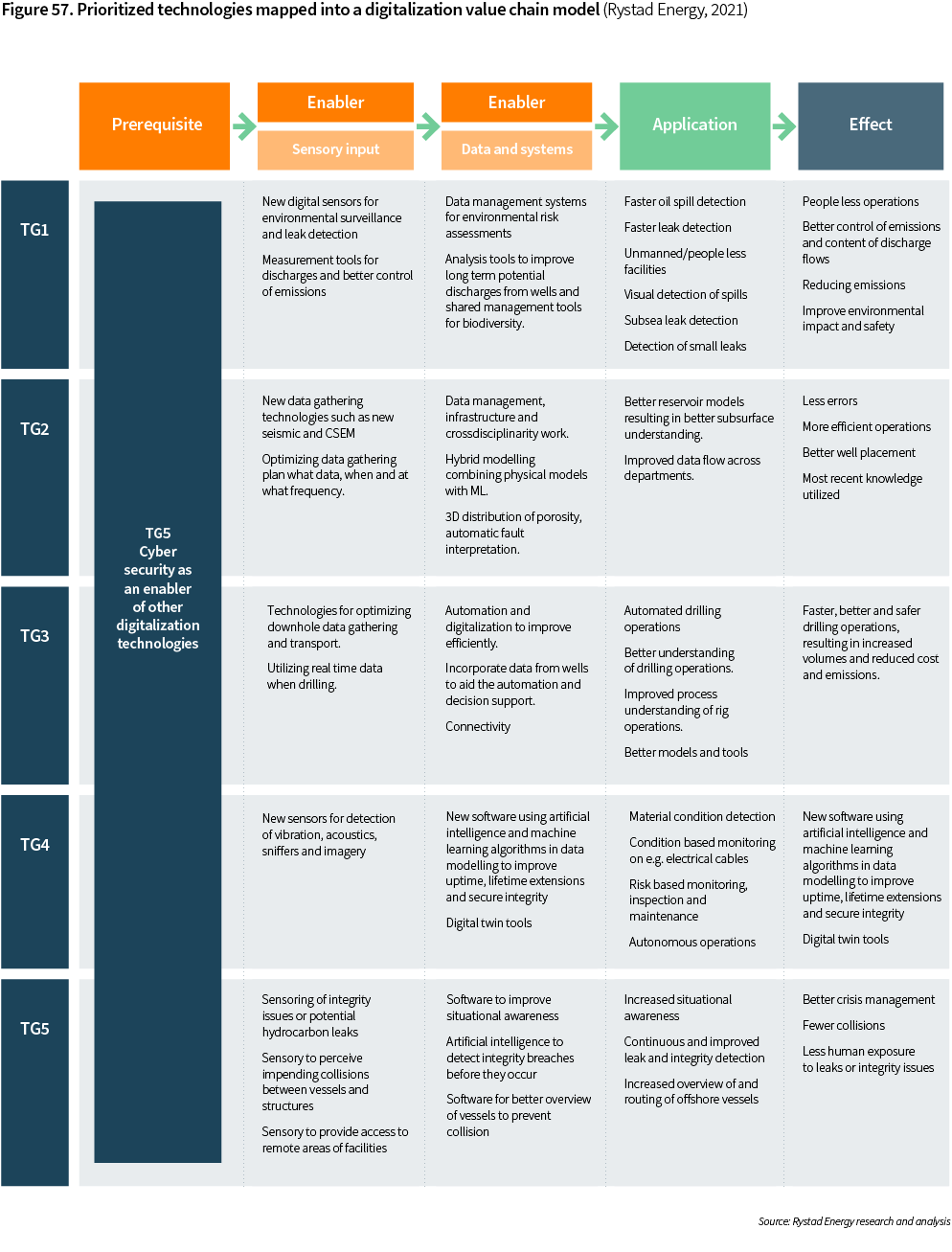

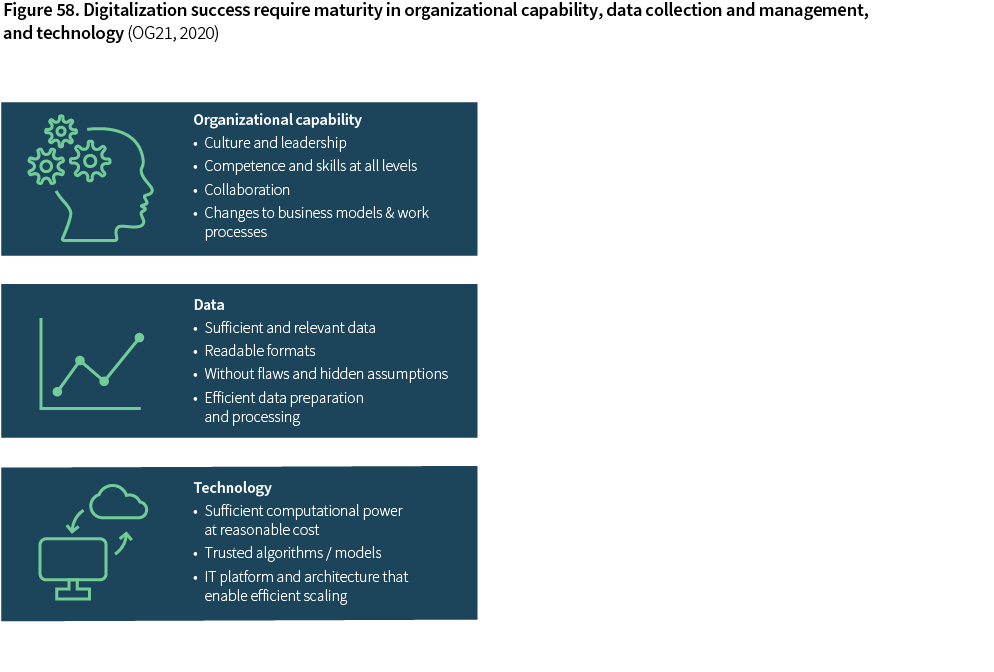

- Digitalization spans across all disciplines. The technology area is fundamental for improved and faster decision processes, which will reduce costs, increase the resource base, reduce GHG emissions and improve safety. The development and application of new tools and solutions such as artificial intelligence, robotics and drones, and digital twins, are key to achieve a digital transformation of the industry. To get there, there is a need for acquiring and processing data more efficiently, a need for more collaboration on data access, data formats and data quality, and a need to change work processes and business models to fully utilize the potential of new technology.

Several factors may inhibit R&D&I that could benefit industry enterprises as well as the society. For example, it might be more attractive to be an early adopter rather than the developer of technology, individual enterprises might alone have a limited application scope of new technology whereas the application scope aggregated across a group of enterprises could be large, and some technologies could have important societal benefits whereas business impact is uncertain or low. Industry collaboration as well as public R&D&I incentives, are required to address such R&D&I challenges.

- Our industrial heritage and world-leading technology and competence could be the steppingstone to new industrial ventures

The Norwegian petroleum industry's contributions to the energy transition and a zero-emission society include three elements:

- De-carbonatization of the petroleum production phase as described in Konkraft's roadmap (Konkraft, 2020), (Konkraft,2021), see Section 3.

- De-carbonization of petroleum value chains, which in addition to abating CO2-emissions, also could contribute to securing the future market for natural gas.

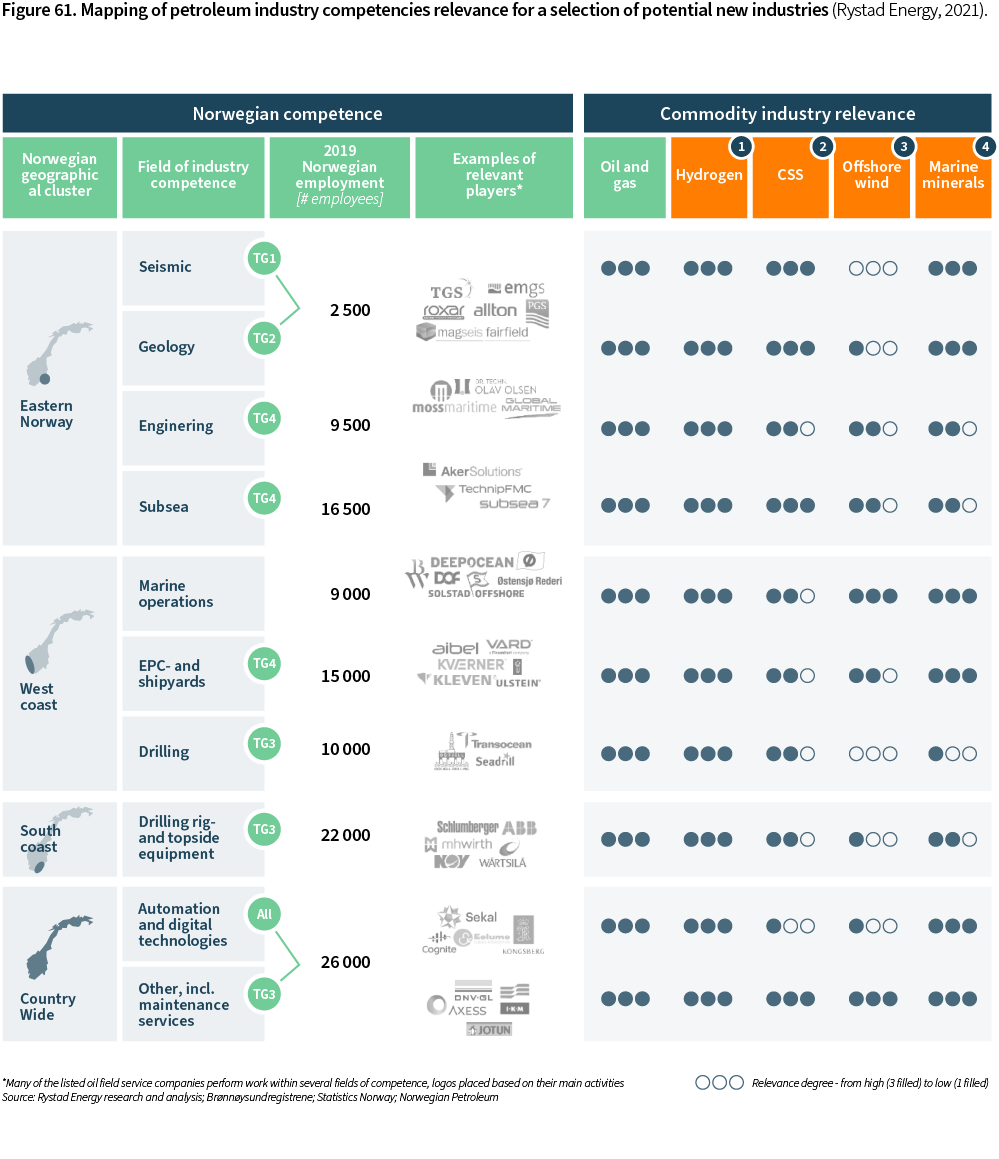

- Participation in and transfer of competence and solutions to emerging low-carbon industries.Just as the Norwegian petroleum industry once was built on competence and skills from the maritime industries, Norway is now well positioned to take a leading role in emerging industries where our world leading petroleum competencies and solutions will provide a competitive edge.

Just as the Norwegian petroleum industry once was built on competence and skills from the maritime industries, Norway is now well positioned to take a leading role in emerging industries where our world leading petroleum competencies and solutions will provide a competitive edge.

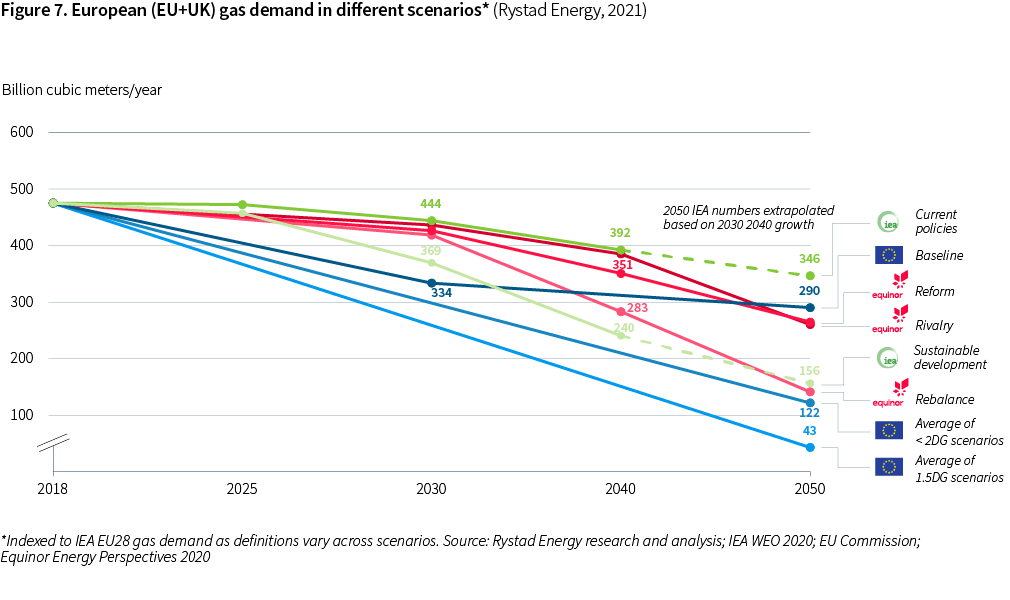

Currently, half of the Norwegian petroleum production is natural gas, and it is expected to stay at this level for the next decade. Nearly all the natural gas is exported to EU countries and the UK where it could continue to replace coal and thus reduce CO2-emissions. Nevertheless, the industry needs to be prepared for a possibly reduced future demand for natural gas because of the EU Green Deal. To secure the market for natural gas in the longer term, the gas can be de-carbonized, either into blue hydrogen and hydrogen-derived fuels like ammonia, or into low-emission electrical energy.

CCS is a key technology in this transition. Competence and solutions from the petroleum industry are essential for safe and lasting storage of CO2, e.g. to understand the geology where the CO2 is sequestered, possible migration paths, as well as monitoring for leaks. In addition to enabling continued sales of natural gas, CCS also represents a wider industry opportunity for de-carbonizing other industries with high CO2-emissions such as cement production and steel production. The Longship project to demonstrate the CCS value chain is therefore very important. We need continued research and innovation to broaden the industry scope for CCS and to make CCS value chains more cost-efficient.

Hydrogen and hydrogen-derived fuels produced from natural gas in combination with CCS is also an industrial opportunity for Norway. Traditionally, hydrogen and ammonia have been used in some industrial processes, but the potential application scope is a lot bigger. Hydrogen could be used as the reducing agent in steel production; as an energy carrier for heating of buildings; as a fuel in electricity generation; and as a transportation fuel. Common for all such new application areas is that new value chains need to be established and demonstrated.

Floating offshore wind energy is still in the demonstration phase, but it represents a great opportunity for Norwegian suppliers and energy companies. In addition to provide electricity to the onshore energy system, offshore floating wind could also produce clean energy for the NCS petroleum activities. Examples of transferable world-class petroleum competence and solutions that could provide a competitive advantage, include: Offshore floating structures; offshore dynamics; mooring and positioning; offshore power connectors and transmission; condition monitoring and maintenance; and robotics and automation.

Marine minerals mining is still in a very early conceptual stage. There are potentially large volumes of minerals at the mid oceanic ridge, which could contribute to meeting a rising demand for minerals. Many challenges need to be solved before seabed mining is realized, e.g.: deep sea mining equipment must be developed; logistics need to be solved; and environmental risks need to be understood, mitigated, and managed. All such challenges resemble challenges the Norwegian petroleum industry is used to handling.

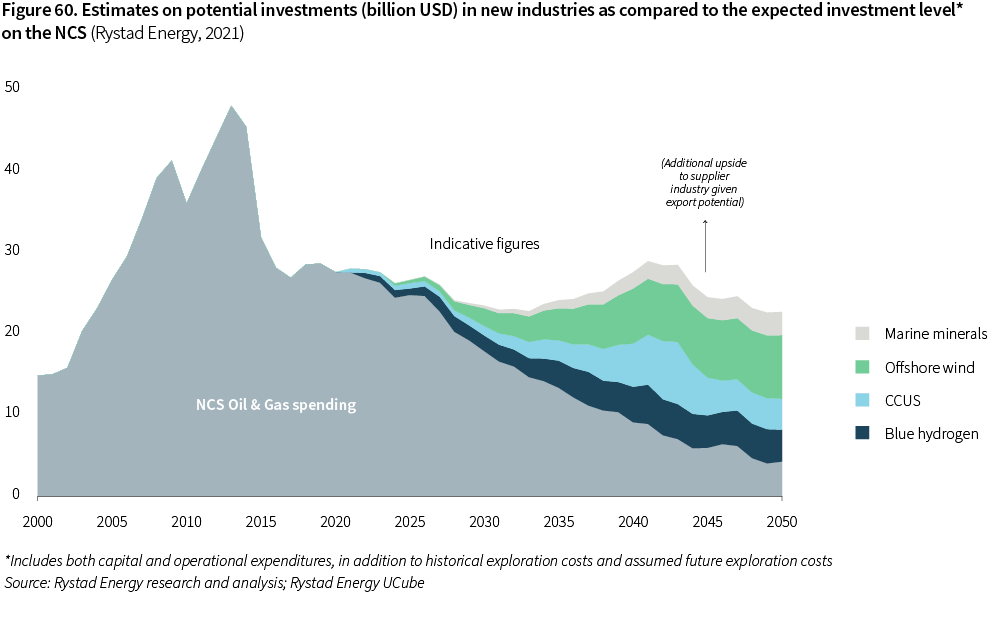

Development of new industries that could contribute to the energy transition, should take place in parallel with the further development of the petroleum industry so that synergies could be leveraged.

- Sufficient technology development and uptake will require leadership, new talent as well as broad collaboration in a well-functioning innovation system

To stimulate the required innovation, OG21 believes three elements are critical:

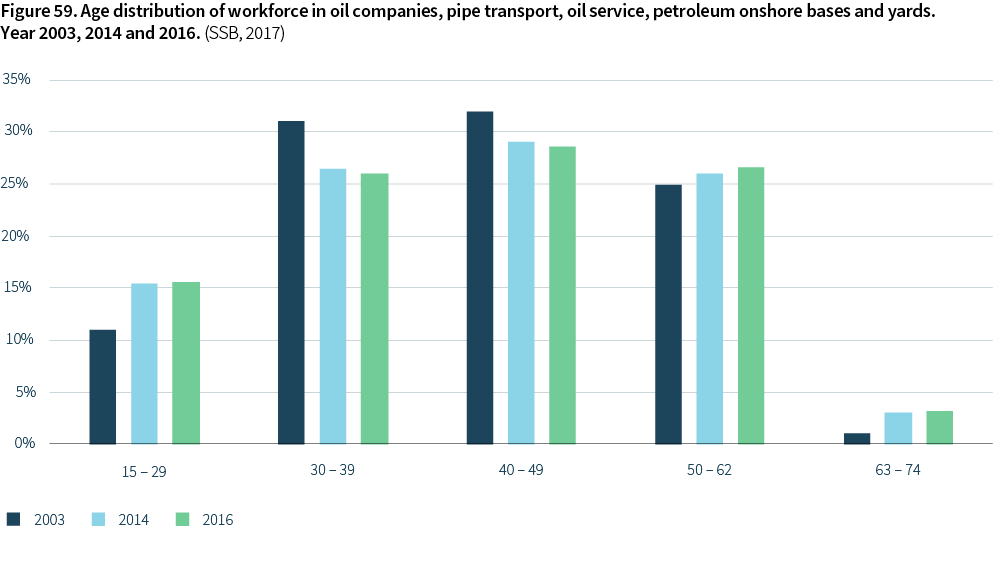

A. We need to attract and develop talent. The petroleum industry is approaching "the great crew change". A high portion of the employees will retire over the next decade, and experience and domain knowledge could be lost. New technology, especially advanced digital technologies, will require new competencies and skills.

Two competence areas could become especially important to maintain the innovation capability:

I. Attracting new graduates by offering exciting and meaningful jobs and by convincing them through tangible results that the industry takes climate change seriously.

II. Training and developing the existing workforce to understand, develop and adopt new technologies.

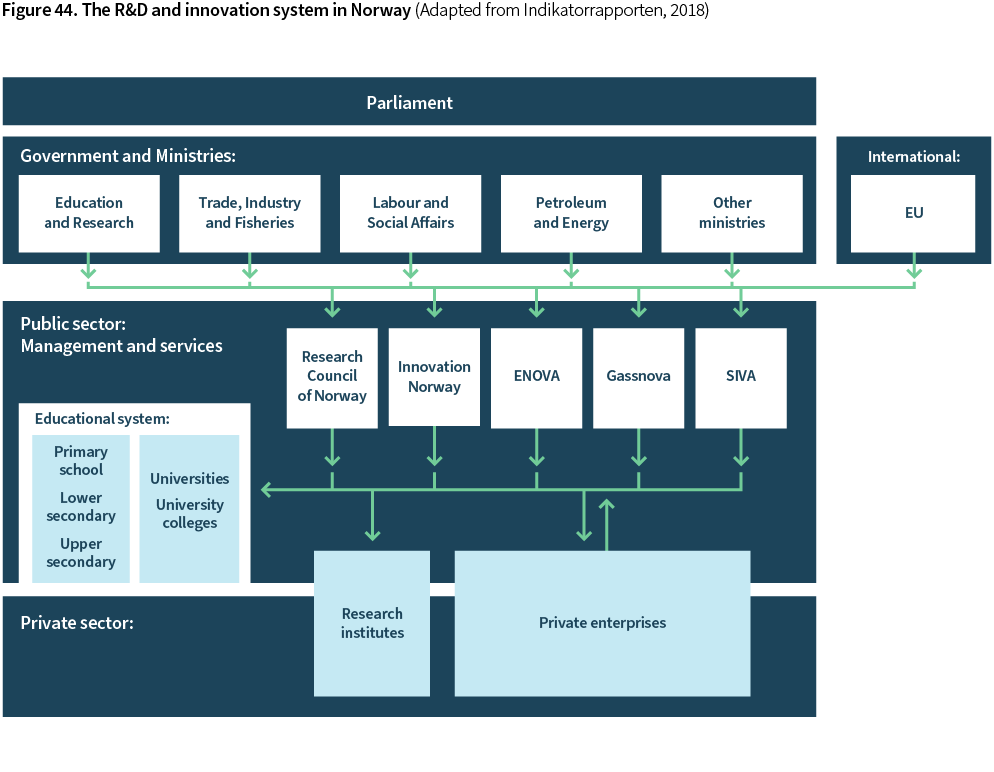

B. The efficient innovation system in Norway needs to be maintained and further developed.

I. The close collaboration between industry, research institutes and universities, stimulated by government funding and tax incentives, has been a successful recipe for the petroleum sector. It needs to continue.

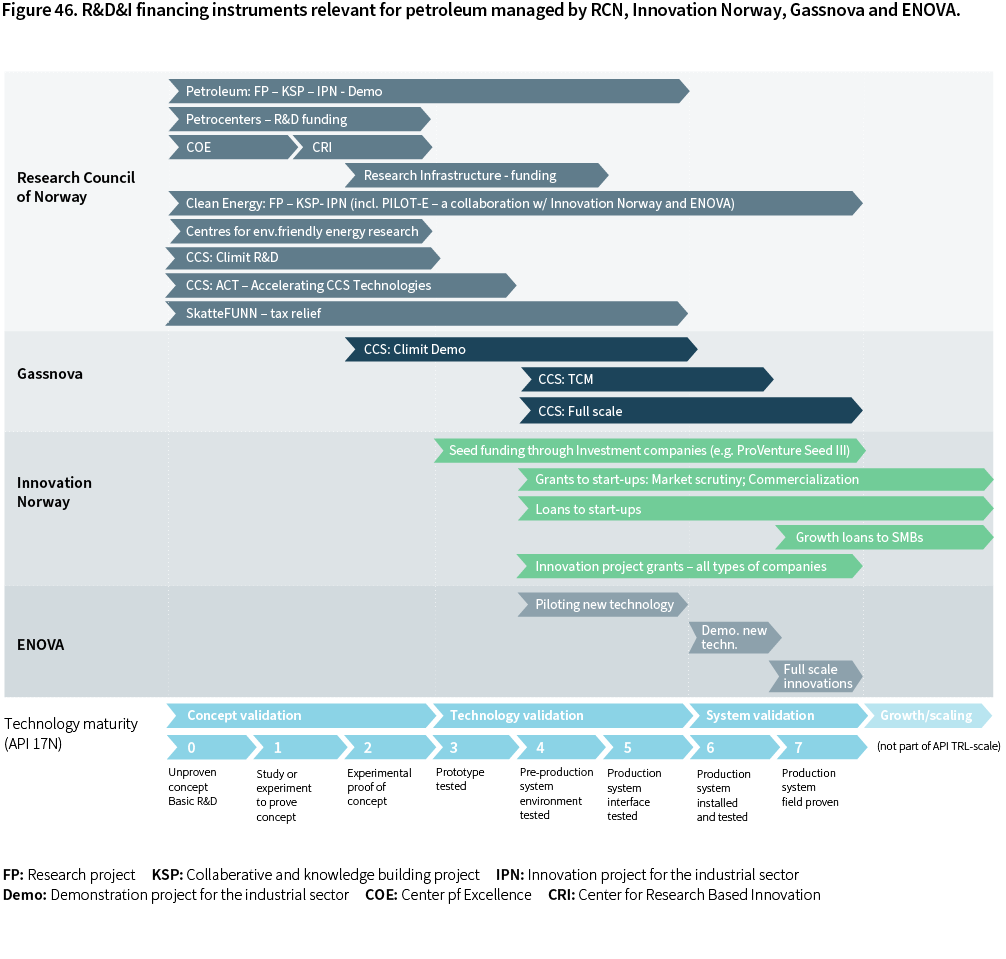

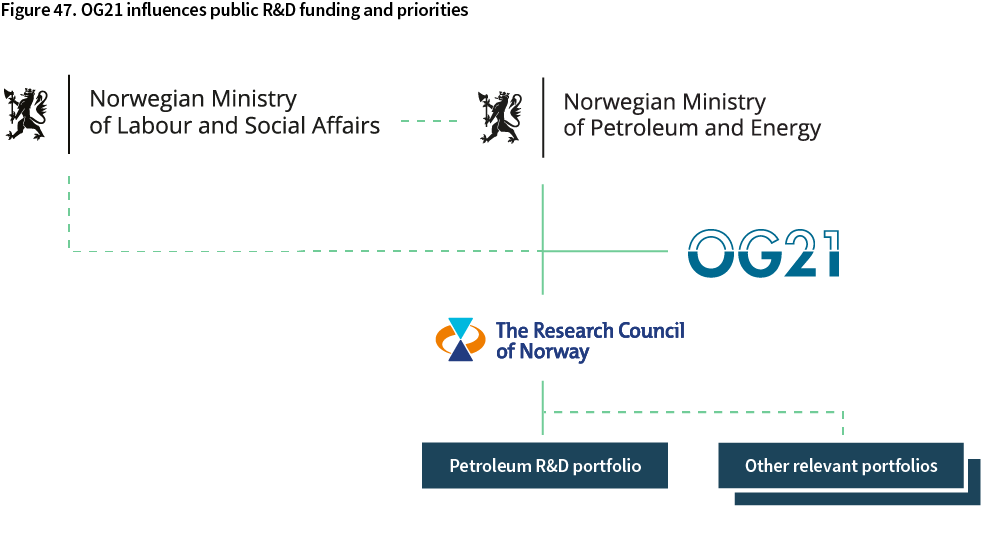

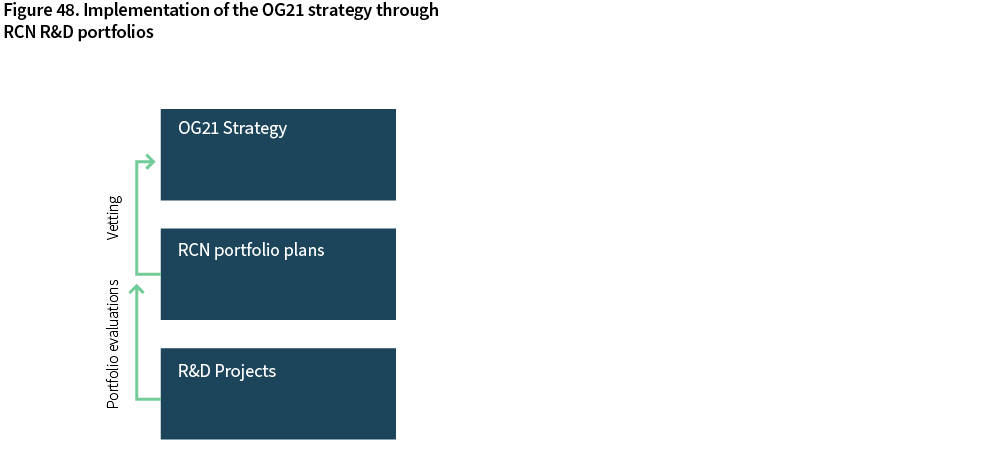

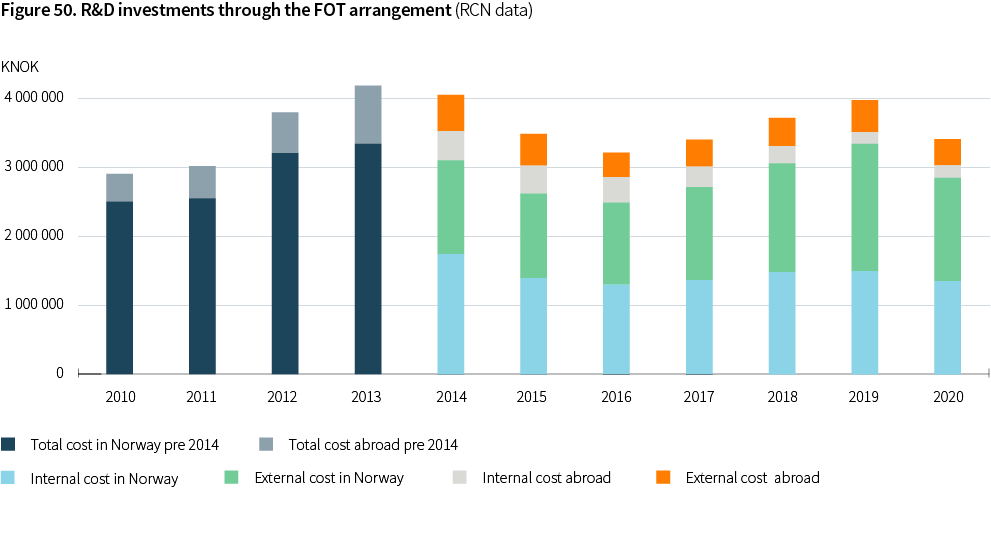

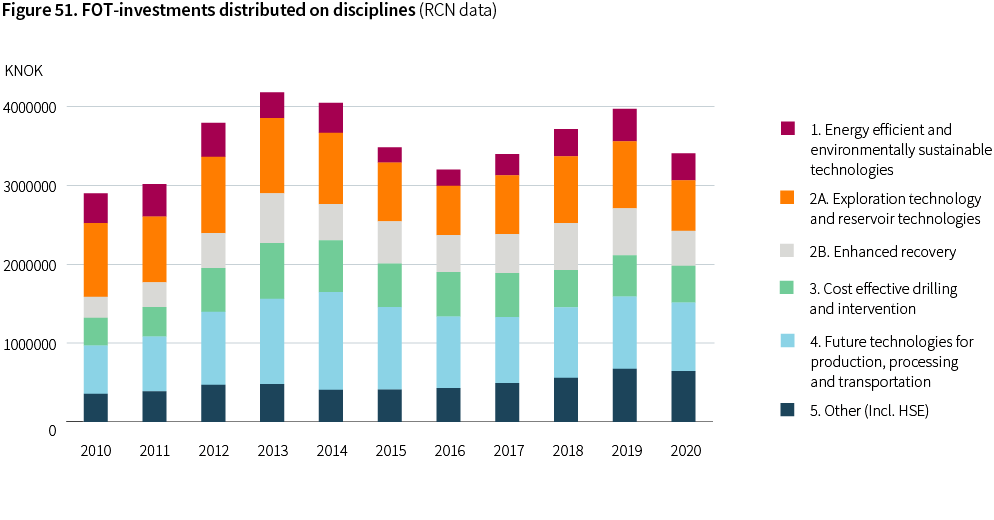

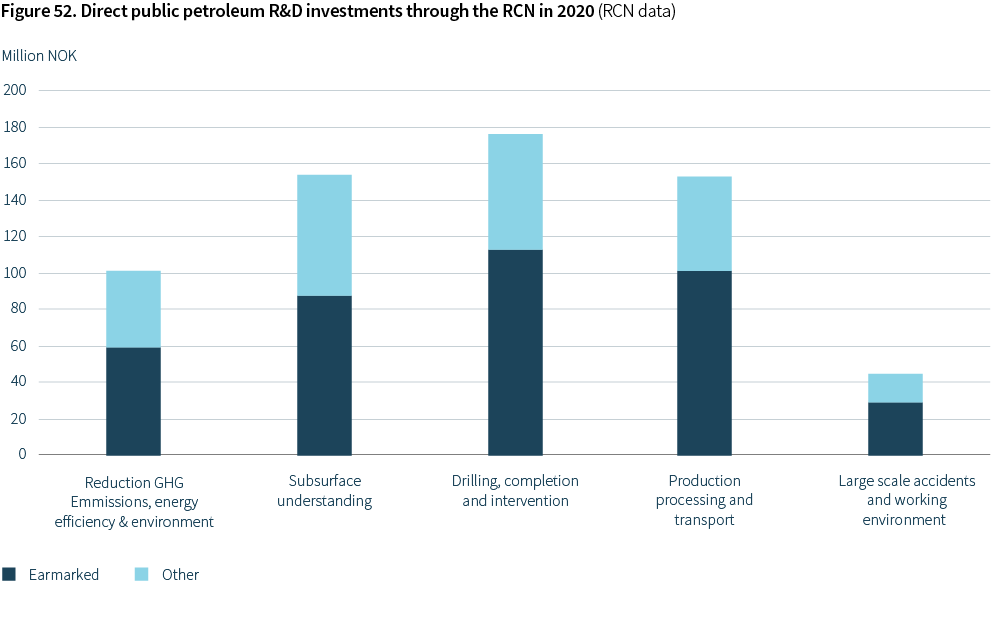

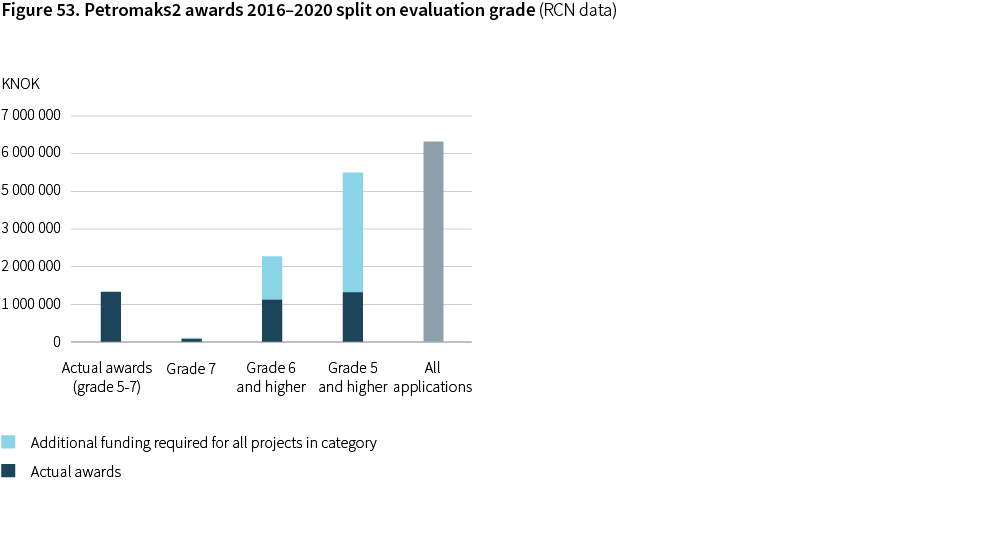

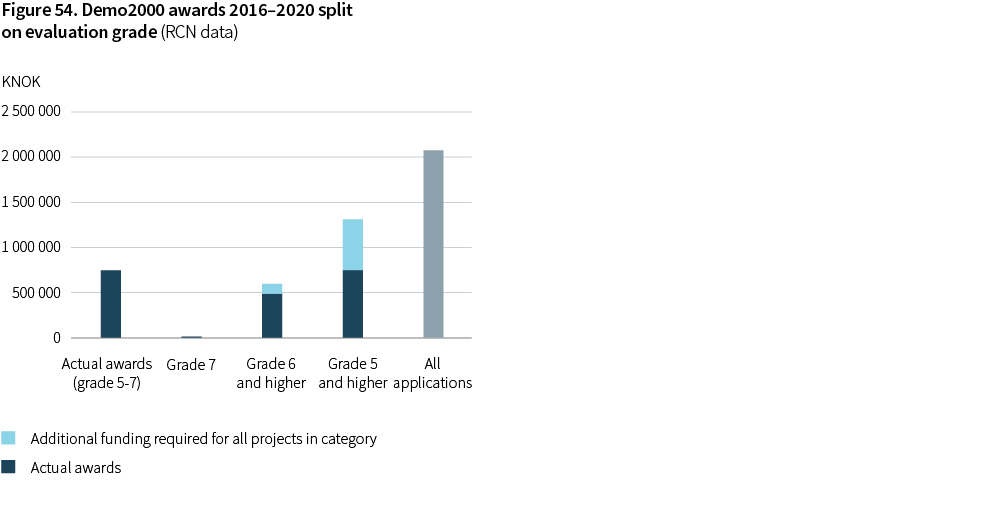

II. Governmental R&D funding for the petroleum sector needs should reflect the technology priorities of this OG21 strategy. R&D strengthens the competitiveness of the NCS, and includes R&D aimed at reducing GHG emissions as well as R&D for more cost-efficient petroleum resource utilization. The high portion of high-quality R&D projects that fails in the competition to obtain governmental funding, in combination with the many challenges the industry is facing, clearly shows that petroleum R&D is under-funded. Governmental funding of petroleum R&D should therefore be increased.

III. Petroleum research programs should encourage cross-discipline R&D, including system perspectives, so that the value of new technologies and how technologies depend on system integration, becomes more apparent. More collaboration across disciplines such as science, engineering, technology, mathematics, and social sciences should be encouraged. The RCN should evaluate new and more agile approaches to R&D funding to complement the current system and identify for what types of projects and calls such approaches could be applied.

IV. The established sectoral approach to R&D is important as it draws attention to specific R&D challenges within an industry and facilitates alignment between industry, academia and the government on objectives and priorities. It does, however, come with some drawbacks. It lacks a high-level agenda setting mechanism and mechanisms for holistic coordination and management. OG21 therefore supports the idea of supplementing the well-established and efficient sectoral approach to R&D&I, with cross-sectoral "missions" to guide R&D&I efforts on societal challenges reaching across sectors.

C. We need visible and consistent technology leadership at executive level:

I. Industry enterprises need to have visible “technology champions” at the executive level that provide consistent signals on the need for technology to maintain competitiveness, and which have the willingness and stamina to develop, test and improve technology. The responsibility for technology should start at the executive level and be distributed throughout the organization. The responsibility should be reinforced through key performance indicators and incentives.

II. The larger oil companies need to have a portfolio rather than a project approach to new technology. Petoro should advocate for technology collaboration across the wide range of production licenses they are involved in. The NPD and the PSA should leverage their influence on technology development and adoption in the production licenses.

III. Executive level technology managers should make sure that technology opportunities are identified and communicated to potential technology suppliers early so that suppliers have a possibility to suggest and develop new value-creating technology in time.

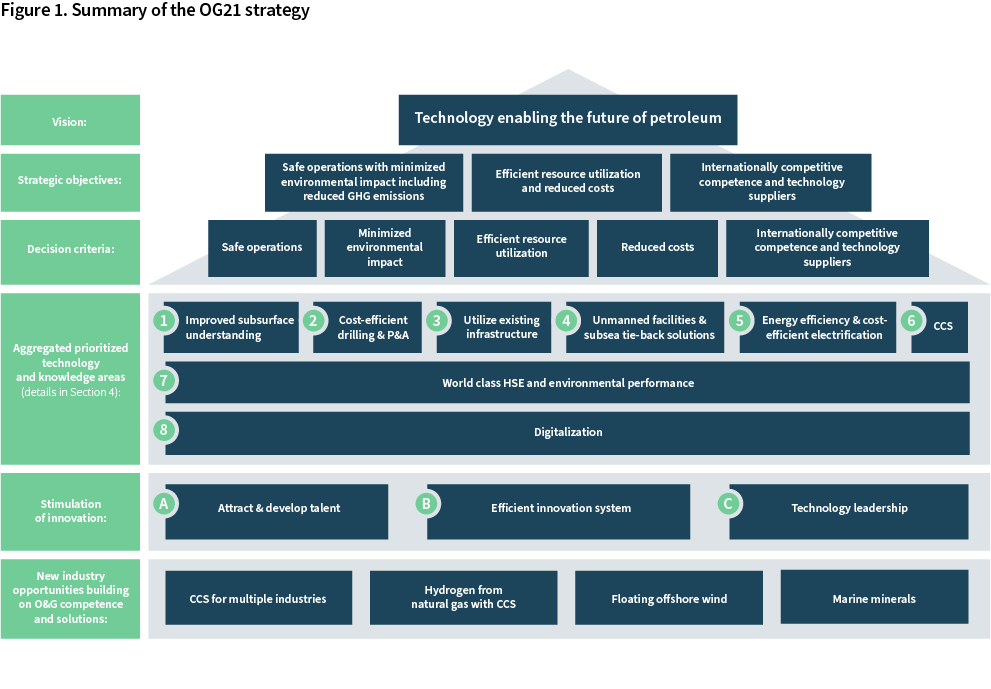

The new OG21 strategy is summarized in Figure 1.

The future of petroleum in the energy transition

The role of the Norwegian petroleum industry in the energy transition

Climate change is occurring, and the world needs to curb GHG emissions. Since fossil fuels are a main contributor to GHG emissions, the petroleum industry needs to contribute to addressing the challenge. Emissions from production should be reduced and new industries should be developed to support the energy transition.

The inertia in the energy systems is however significant. For instance: A typical fossil fueled power plant operates for at least 25 years; an internal combustion engine (ICE) car has a life expectancy of more than 10 years; the electrification of societies requires massive investments in power grids and buildings and will take time. In addition, oil and gas is hard to replace for many end-uses such as for fertilizers and industry products. This means that even with global decisions to curb emissions, there will be demand for oil and gas for many decades to come. How fast the transition will go and how the oil and gas demand will be impacted, is dependent on: (i) how successful global leaders are in developing and implementing policies and binding agreements, and (ii) cost and technology advancements of low-emission alternatives both on the energy supply and demand sides.

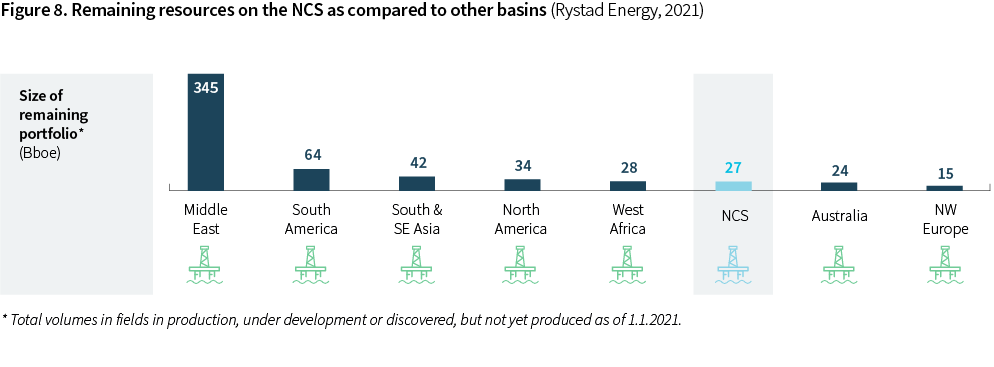

Less than half of the estimated resources on the NCS has so far been produced, and the NCS is currently highly competitive in the market with low lifting costs and low CO2-emissions per barrel o.e.

OG21 believes that the NCS and the Norwegian petroleum industry can continue to deliver value to the Norwegian society in terms of revenue and jobs along three dimensions:

- Successfully compete for market shares in the oil and gas markets. Future markets and prices are uncertain, and to stay competitive the production needs to be highly cost-efficient, and the industry needs to deliver on the ambitious GHG emissions targets set forward by Konkraft (2021).

- Secure deliverables to the European market for natural gas by de-carbonizing the gas. CCS is a key technology to de-carbonize natural gas, either into low-emission hydrogen or electrical power.

- Contribute with competencies and solutions to the development of new industries, e.g. blue hydrogen and ammonia, CCS, offshore wind power and marine minerals mining. Developing such industries would assist in the energy transition and should take place in parallel with the further development of the petroleum industry to leverage synergies.

Development of resources on the NCS should continue. The NCS offers stable and secure supply in addition to among the lowest CO2-emissions in the world.

Energy policies setting the direction

2.2.1 National policies

Several governmental and industry policy documents for the Norwegian petroleum sector have been published or updated in recent years. Combined they describe a Norwegian petroleum industry that will:

- Continue to be important for the Norwegian society in the coming decades, although with a gradually declining relative importance for the society.

- Need to reduce its CO2-emissions, both in the production phase and along the value chains.

- Contribute with technology, competence, and solutions to enhance its own competitive edge and also to develop new industries.

The Governmental white paper launched in June 2021 on long-term value creation from Norwegian energy resources (Meld.St.36 (2020-2021)), describes four main objectives:

- Value creation that provides new jobs in Norway. The Government wants the Norwegian renewable energy resources, to the largest extent possible, to be utilized and refined in Norway.

- Electrification to make Norway "greener". A new electrification strategy is launched as part of the white paper. It aims at finding a balance between the need for more power and improvements to the grid and the associated environmental consequences and concerns.

- Establishment of new profitable industries, such as hydrogen, offshore wind, CCS and battery production.

- Further development of a petroleum industry fit for the future and aligned with Norwegian climate goals. In addition to continued stable frame conditions, the Government wants to actively contribute to R&D on good resource utilization and lower operational GHG emissions. The Government also wants to continue the established exploration policy of making new areas available in regular licensing rounds.

In "Perspektivmeldingen 2021", the Government describes which challenges the Norwegian society faces towards 2060 and the Government's strategies to address those challenges. Climate change and its impact globally and locally receives high attention in the white paper. It describes a need for ambitious national measures as well as a need for global cooperation. To meet the goals in the Paris Agreement, large and expensive emission cuts must be implemented globally and nationally. The white paper nevertheless predicts that there will be a continued need for new investments in oil and gas, and that the consequences for the Norwegian oil and gas activities therefore could be modest, (Meld.St. 14 (2020-2021)).

In the white paper "Klimaplan 2030", the Government presents its plan for how Norway will achieve climate goals and green growth towards 2030. The climate plan has a main emphasis on emissions that are not part of the EU quota system, i.e. transport, waste, agriculture, construction and parts of the emissions from industry and oil and gas activities. It does however also address some emissions that fall under the EU quota system, including emissions from the oil and gas activities. The Government describes in the white paper that it will increase the CO2 tax so that the combined levy, including quotas, reach 2000 NOK/ton CO2 by 2030, (Meld.St. 13 (2020-2021)).

The industry employers' organization NHO and the labor organization LO have together published a white paper, "The energy and industry platform", on the transformation of the industry to a low-emission society (NHO/LO, 2021). In the report NHO and LO emphasizes that the Norwegian industries' competitiveness depends on:

- An energy policy that stimulates ambitious industry development, and includes strengthening and upgrading of the power grid, increased renewable power production, and new measures to improve energy efficiency.

- Access to renewable energy at competitive prices.

- A further development of a safe and efficient Norwegian power system that is based on principles of business and socio-economic profitability, but which provide the opportunity for industry production to be scaled up in response to demand and for a corresponding faster development of the power grid.

- A holistic electrification strategy that combines industrial opportunities, climate goals and improvements in the power system.

Konkraft published early 2020 "A climate strategy towards 2030 and 2050" for the NCS, with support from all its members: the Norwegian Oil and Gas Association, the Federation of Norwegian Industries, the Norwegian Shipowners Association, the Confederation of Norwegian Enterprises and the Norwegian Confederation of Trade Unions. A status report was published in 2021. The strategy sets forth ambitious climate reduction targets of 40% reduction in operational GHG emissions by 2030, further reduced to near-zero by 2050. It also suggests how the petroleum industry can contribute to reducing GHG emissions along the value chain of hydrocarbons and simultaneously create new industries, (Konkraft, 2020) and (Konkraft, 2021). The 40% target for 2030, was further strengthened to 50% reductions by 2030 through a Parliament request forming part of the Corona stimulus package for the petroleum industry, agreed in the Parliament in June 2020.

2.2.2 Global policies influencing the energy sector

Norway is one of 196 countries that have adopted the legally binding international treaty on climate change developed at the UN COP21 meeting in Paris in 2015. The goal of the agreement is to limit global warming to well below 2 degrees Celsius, and preferably to 1.5 degrees Celsius, as compared to the pre-industrial levels. The Paris Agreement forms the basis for EU as well as Norwegian energy policies.

The 6th assessment report from IPCC is being developed. The contributing report from IPCC's Working Group 1 on the physical science of climate change, released early August 2021, further strengthens the call for action to curb GHG emissions (IPCC, 2021).

The 2030 Agenda for Sustainable Development, adopted by all the member states of UN, is another UN policy document with high impact. Its 17 Sustainable Development Goals are widely referred to in regional and national policies and strategies.

2.2.3 The EU Green Deal is transforming the European energy landscape

The European Green Deal (EGD), the climate and growth strategy for EU, was launched in December 2019. The EGD and its related targets, measures and strategies are aimed at securing a green and digital transformation of the EU society, economy, and industries. (European Commission, 2019b).

The EGD has transformational impact on all sectors in EU, including the energy sector. The energy sector today contributes with around 75% of EU's GHG-emissions. The transformation from a fossil-fuel based energy system to a system based on renewable energy is therefore an essential part of the EGD.

At the core of the EGD is a new EU climate law which put forward a target of making EU carbon-neutral by 2050. On the path there, GHG emissions shall be decreased by 55% within 2030. The law passed the EU Parliament in May 2021 and entered into force in July.

Numerous and comprehensive plans, programs and underlying strategies have been developed to support the EGD and set strategic direction. The next step is to transform the EGD supporting strategic documents into directives and regulations. The "Fit for 55" package presented in July 2021 is part of that.

The EGD impacts Norway both through the adoption of regulations and directives, and through changes to physical and financial value chains. For enterprises and organizations historically involved in the Norwegian petroleum industry, impact on at least three areas could be envisaged:

- Production costs:

- Revision of the ETS quota system will increase costs of CO2-emissions. Impact on petroleum production in Norway will depend on how the CO2-tax in Norway is adjusted.

- Revision of the ETS quota system will increase costs of CO2-emissions. Impact on petroleum production in Norway will depend on how the CO2-tax in Norway is adjusted.

- Access to capital and financing:

- The EU Taxonomy, the strategy for sustainable financing and the directive for non-financial reporting, could make investments in petroleum projects less attractive.

- Research and innovation funding may create opportunities for enterprises and organizations that have growth strategies that align with EU's strategies, see Section 2.6 for details.

- The EU Taxonomy, the strategy for sustainable financing and the directive for non-financial reporting, could make investments in petroleum projects less attractive.

- Access to market & new industry opportunities:

- The EU demand for natural gas could be reduced unless the natural gas is de-carbonized and delivered as other energy carriers, see section 4.

- The EU Hydrogen strategy opens for blue hydrogen (produced from natural gas with CCS) in a transition period, but the strategy's main objective is to make green hydrogen competitive.

- The EU Offshore renewable energy strategy aims at making offshore renewable energy a core component of Europe's energy system. It addresses various types of offshore renewables, but offshore wind is expected to be the major contributor.

- The EU demand for natural gas could be reduced unless the natural gas is de-carbonized and delivered as other energy carriers, see section 4.

The energy transition – global forecasts

2.3.1 Wide span in global energy forecasts

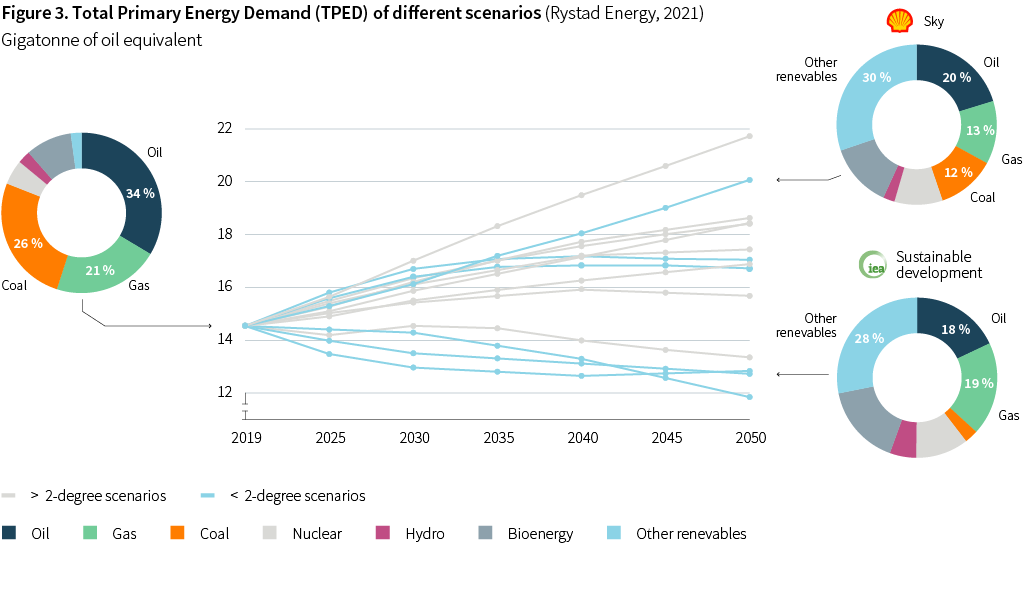

The global total primary energy demand (TPED) in 14 scenarios provided by 5 well recognized organizations[1], is shown in Figure 3. There is a considerable spread in the forecasts towards year 2050, depending on the assumptions they are based on. The assumptions on whether the world meets the targets and ambitions of the Paris-agreement and to which extent CCS is implemented, are the most important.

With exception of the Shell Sky scenario, which assumes an even more extensive use of CCS than the other "less than 2 degrees" scenarios, the "less than 2 degrees" scenarios describe an energy future where the world's energy demand peaks before 2035. They describe a future where renewables such as hydro, bioenergy, solar power, and wind power, dominate the energy mix and where coal has largely been phased out. The relative contribution of oil and gas is smaller than today, but still significant, typically 30-40% of the energy demand. In all the scenarios where the world meets the 2-degree target, CCS plays an important role.

2.3.2 Oil and gas demand during the energy transition

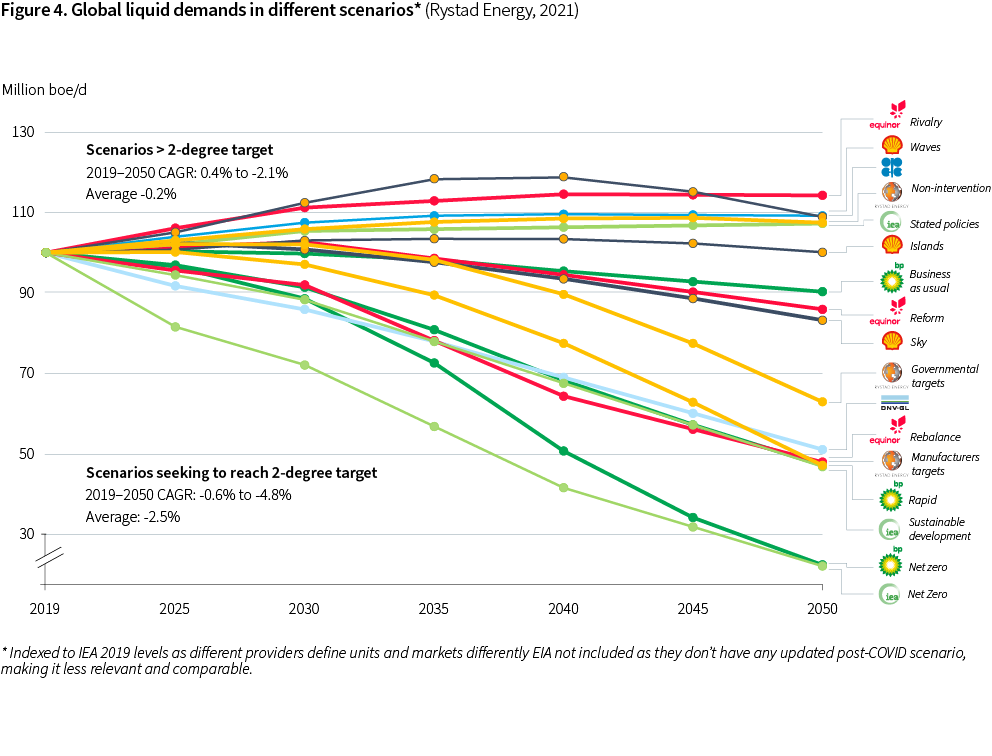

Oil and gas are likely to continue to play an important role in the global energy mix in the decades to come, but the long-term demand is increasingly uncertain. Figure 4 shows the large span of liquid demand scenarios from recognized sources such as IEA, DNV GL, Equinor, BP and OPEC (Rystad Energy, 2021).

The scenarios compared can largely be grouped into two: those describing a transition to an energy mix that meets the 2 degrees target of the Paris-agreement, and those that do not meet the target.

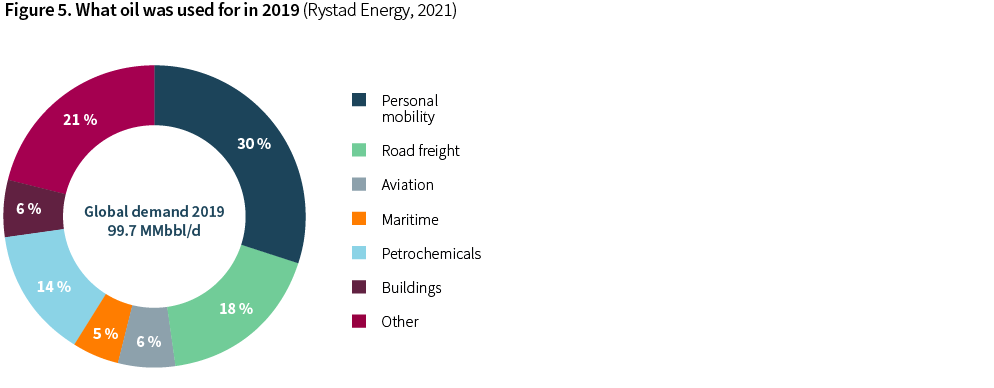

The “low carbon” scenarios reflect major technological and investment shifts both on the energy supply and the energy demand side. For instance, and as Figure 5 indicates, large scale electrification of road transportation could alone address nearly half of today’s oil demand (30% of the 2019 oil production was used for fueling light vehicles and buses and 18% was used for light and heavy trucks). Provided that the electricity is generated from renewables or de-carbonized fossil fuels, electrification of the transport sector is becoming increasingly more attractive, both from an emission and an economic perspective.

Other parts of today's oil use could be more challenging to replace. Maritime transport and aviation require a much denser energy storage than what today's electric batteries can offer, and further advancements of batteries, biofuels, hydrogen, and hydrogen-derived fuels will be important. Furthermore, oil is used in petrochemical and other industries where it could prove hard to replace. For such industries, the search for cost-efficient alternatives to oil as well as re-cycling of oil-derived products, will be important to reduce demand.

The transition to net-zero societies globally is therefore going to take time, and oil is likely to be needed for many decades to come.

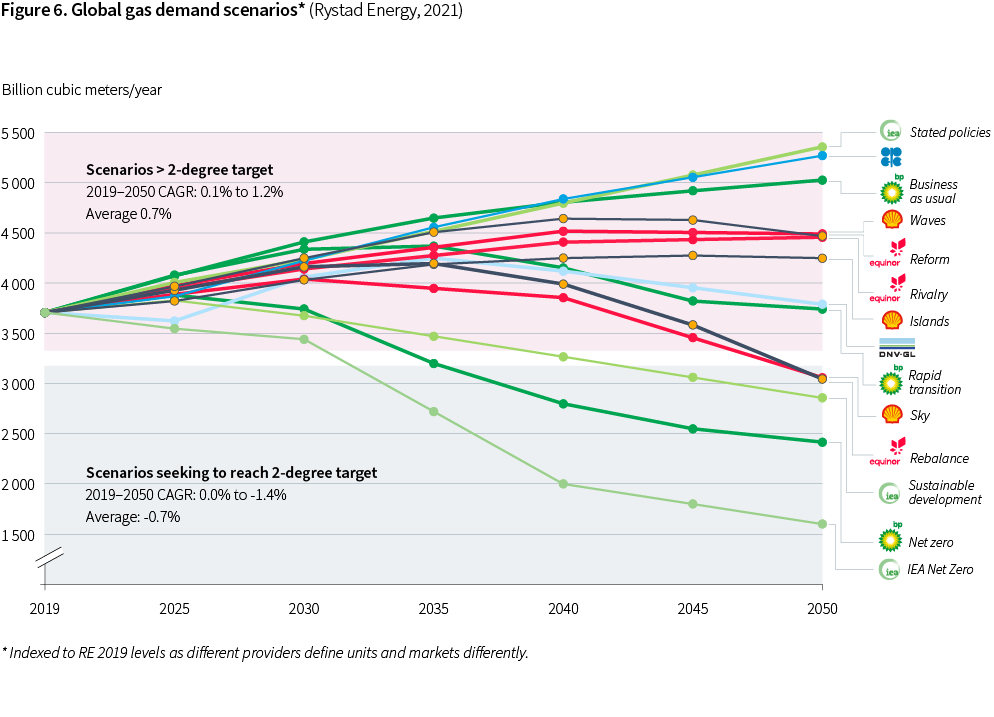

The future demand for natural gas is also uncertain as Figure 6 shows. However, all scenarios that aim at meeting the Paris-agreement 2-degree target, predict that also global gas demand will peak by 2035 and decline towards 2050.

Gas markets are regional to Asia, the Americas and Europe. Long distances between the regional markets, lack of import/export infrastructure and high shipping costs limit the trade between the markets.

More than 95% of Norway’s gas production is piped to the European market, with the remainder shipped as LNG to other markets. The European market is therefore of key importance for the sales of natural gas from the NCS.

Most scenarios show robust demand for natural gas in Europe near-term and until year 2030. The use of natural gas in modern gas power plants results in only half the CO2-emissions from coal-fired power plants, and as such natural gas is an important energy carrier to reduce European emissions in the short to medium term.

However, EU is implementing its Green Deal with a zero-emission vision for 2050, and in the scenarios supporting the vision, natural gas without CCS plays a limited role. De-carbonizing natural gas would therefore be crucial in a long-term strategy for the Norwegian gas. Gas-to-X technologies (blue hydrogen, electricity or other energy carriers) with CCS are key elements of such a strategy.

2.3.3 The IEA Net Zero by 2050 scenario

The IEA Net Zero by 2050 scenario (NZE) has drawn significant attention since its release in May 2021. It provides a roadmap to achieve net zero CO2 emissions by 2050, and the path described meets the 1.5 degrees ambition of the Paris Agreement with a 50% probability.

The NZE predicts a peak in global energy demand by 2023 before a reduction of 10% towards 2050. With a growing population, the energy demand per capita would over the same period be reduced by 25%. Oil and gas would in 2050 contribute with 8% and 11% respectively of the total energy supply (8% natural gas with CCUS, and 3% without).

The NZE hinges on many uncertain assumptions. IEA highlights large behavioral changes on the individual level, modern bioenergy and its associated large land-use, and a fast pace of CCUS adoption, as the three most important. Several other assumptions stand out in addition, most notably the need for alignment and concerted efforts on a global scale, massive investments e.g. in electricity systems, a rapid maturing and broad adoption of new technology such as hydrogen, and access to sufficient quantities of rare earth minerals and critical metals.

To facilitate an orderly transition to zero-emission societies it is going to be important that policies to curb supply are aligned with policies to curb demand. In a comment to the NZE, Jason Bordoff of Columbia University writes: "Unless both supply and demand change in tandem, merely curbing the oil majors’ output will either shift production to less accountable producers or have potentially severe consequences on economic and national security interests while doing little to combat the climate crisis" (Bordoff, 2021). Bordoff bases his analysis on the fact that only 15% of the oil delivered to the market is produced by international oil companies (IOCs). The bulk of the oil (57% in 2018) is produced by national oil companies in OPEC countries plus Russia, and the remainder is produced by independents (OG21, 2020b).

The NZE assumes an oil price decline from 37 $/bbl in 2020 to 24 USD/bbl in 2050 to balance supply and demand, and states: "The rapid drop in oil and natural gas demand in the NZE means that no fossil fuel exploration is required and no new oil and natural gas fields are required beyond those that have already been approved for development". Following the arguments of Bordoff in his evaluation of the NZE, the assumed oil price decline would have to be driven by reduced oil demand resulting from substitution with low-emission energy sources outcompeting fossil fuels on costs, and not by curbing oil supply. As such, the eliminated need for new investments in exploration and field development in the NZE should be a consequence of CO2-pricing and large-scale development of low-emission energy, and not a result of unilateral political decisions on banning exploration and field development.

If the NZE projected price trajectory should materialize, it is not a given that remaining resources in existing fields are more cost and emission effective than resources in new fields. For the NCS, new resources close to existing infrastructure could very well be economically viable within the 30-35$/bbl oil price range projected by the NZE in the period 2030-2040. This is the likely period much of the remaining resources on the NCS would be realized. The associated GHG emissions from such new resources could be substantially lower than from some of the contingent resources in existing fields globally.

The NZE is one of many scenarios describing the on-going and necessary global energy transition. When evaluating petroleum technology needs for the future, it should be treated as such, although with a considerable weight given the potentially high impact it may have on policy development.

[1] IEA WEO 2020, IEA NZE, Shell Scenarios 2020, OPEC WOO 2020, Equinor Energy Perspectives 2020, DNV GL ETO 2020.

Norwegian petroleum resources – less than half produced and sold

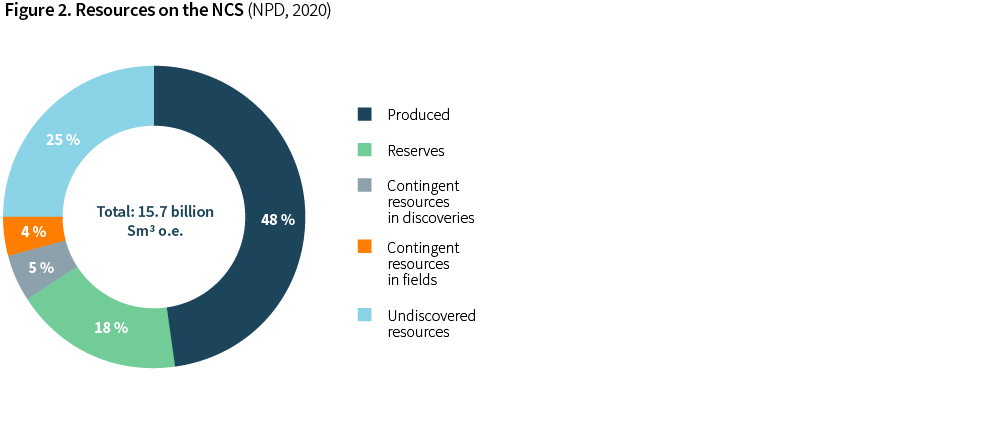

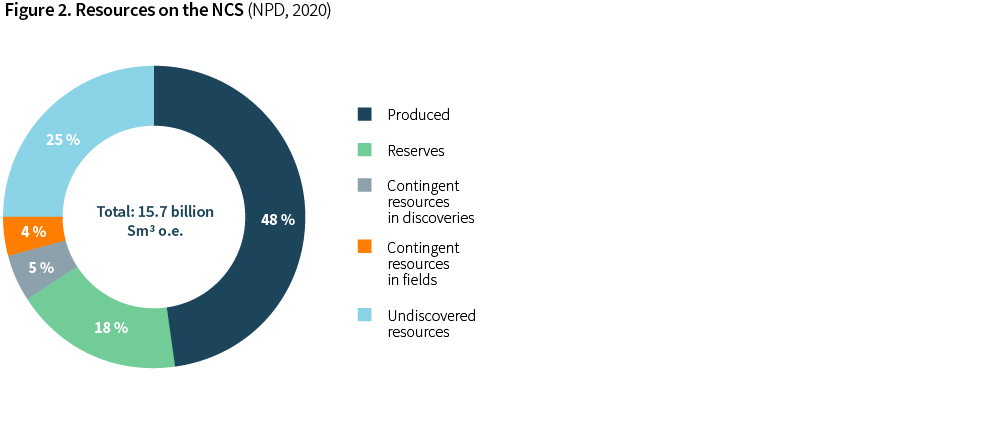

Even though the NCS is maturing, less than 50% of the potential economically viable resources have been produced (NPD, 2020).

As Figure 2 shows, 18% of remaining resources are booked reserves, 4% are contingent upon investment decisions in producing fields, and 5% are contingent upon investment decisions in the existing discovery portfolio. The contingent resources add up to more than 9000 million boe, equivalent to more than 4 times the volumes of the Johan Sverdrup field.

25% of estimated resources are yet to be found. The Barents Sea dominates this category, although related with a high uncertainty span. Half of the Barents Sea estimate is from unopened areas far North. The North Sea and Norwegian Sea are believed to still hold significant, undiscovered resources. The continued discovery trend of small, but still commercial fields, supports this belief.

Improved subsurface understanding, new technology in all disciplines described by OG21's technology groups as well as changes to work processes are all important elements in the maturing of contingent resources and finding and maturing new resources to cost-efficient production with relatively low GHG-emissions.

There are considerable remaining resources on the NCS. Still, in a global context, the NCS resources are rather modest. The bulk of remaining resources globally is in the Middle East and the Americas.

On OG21, its vision and the strategic objectives

2.5.1 Mandate and organization

OG21 has its mandate from the Norwegian Ministry of Petroleum and Energy (MPE). The purpose of OG21 is to "work for efficient, safe and environmentally friendly value creation from the Norwegian oil and gas resources. This will be achieved through a coordinated engagement of the Norwegian petroleum cluster within education, research, development, demonstration, and commercialization. OG21 will inspire the development and use of new and improved competence and technology aligned with an energy system in transition and the goal of reduced greenhouse gas emissions".

OG21 brings together oil companies, universities, research institutes, suppliers, regulators and public bodies to prepare a comprehensive national technology strategy for the petroleum sector which will guide the industry's and the authorities' technology and research efforts.

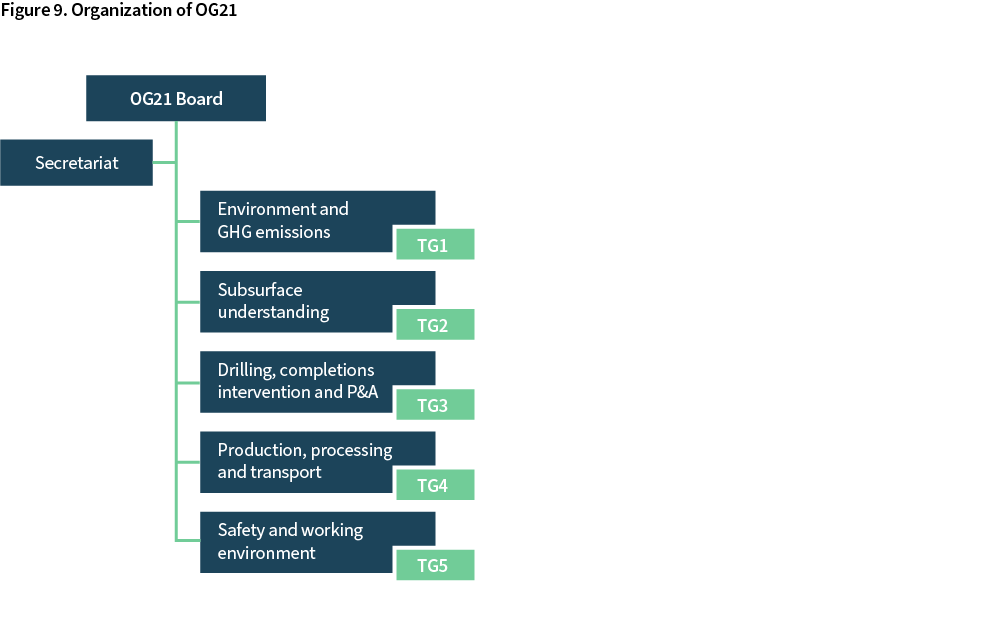

Technology opportunities and challenges are being identified, described, and prioritized by technology groups (TGs) within the themes shown in Figure 9. The TGs have members from oil companies, universities, research institutes, suppliers, regulators, and public bodies.

2.5.2 Vision and strategic objectives

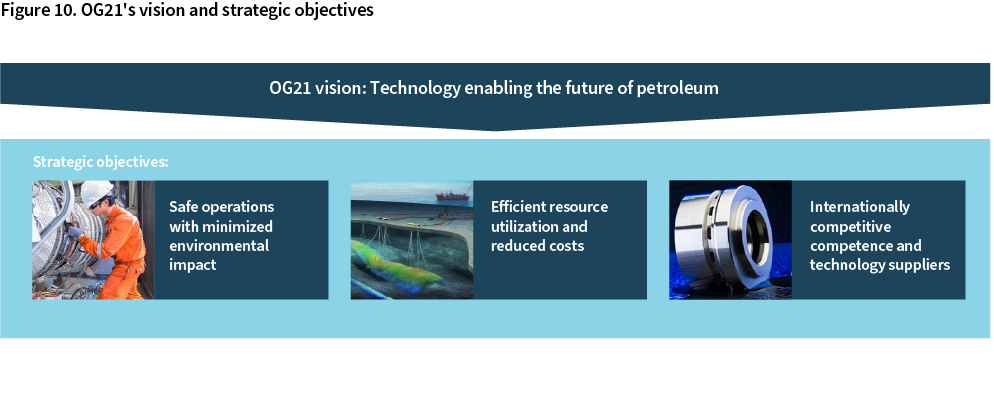

OG21's vision and strategic objectives are shown in Figure 10.

OG21's vision "Technology enabling the future of petroleum", expresses a desire to continue providing petroleum, solutions and services to the global energy markets, but with the understanding that the markets are changing: Technology will be essential to align with a future where GHG emissions related to production are dramatically reduced, petroleum products are de-carbonized, reduced demand for oil and gas have pressed oil and gas prices down, and stakeholders have expectations of excellent safety and environmental performance.

The vision is supported by three strategic objectives that combined bring us to this future.

The strategic objectives have formed the basis for the identification and prioritization of technology and competence needs described in Section 4.

2.5.3 Funding

OG21 is co-located with the Research Council of Norway. In addition to hosting OG21, RCN provides administrative assistance to OG21.

The Ministry of Petroleum and Energy is OG21's main sponsor. In addition, OG21 receives funding from energy companies. Funding energy companies in 2021 are Equinor, Vår Energi, Lundin Norway, OMV, ConocoPhillips and Neptune Energy.

The OG21 budget, income and spending is disclosed in the annual reports published on the OG21 website.

2.5.4 Interfaces with other 21-processes

OG21 has important interfaces with other strategy processes:

Energi21 is the national technology strategy for renewable energy and transportation. OG21 has interfaces with Energi21 on energy efficiency, carbon capture and storage (CCS), power transmission and grids, and use of renewables for power supply.

Maritim21 is the national technology strategy for the maritime industry. Interfaces with OG21 include marine operations, mobile drilling units, gas transport, emergency preparedness technologies and automation and autonomy.

Prosess21 is the national strategy for the process industries. Interfaces include energy efficiency, CCS, and power transmission and grids.

Digital21 is the national strategy for digitalization of Norwegian industries. Interfaces include all OG21 prioritized technologies with a high degree of digitalization. Digital21 emphasize 5 key strategic technologies that all are highly relevant for OG21: AI, big data, internet-of-things, autonomous systems, and cyber security.

Representatives from the other 21-processes have been engaged throughout the development of this OG21-strategy.

The 21-processes are organized in accordance with the sectoral approach to R&D in Norway, discussed in section 5.2.1. It comes with some obvious benefits such as ensuring alignment between industry, academia and the ministry on objectives and priorities. As such the approach has proven efficient to produce results with significant impact.

The sectoral approach also has some drawbacks, especially related to cross-industry coordination and holistic goals. It could therefore benefit from being supplemented with elements from a mission-oriented approach on societal challenges.

The need for new technology to improve competitiveness

What makes an oil and gas province competitive?

The prospect of attractive returns is fundamental for attracting investments. Traditionally Net Present Value (NPV) and similar economical metrics have been used to assess the return of petroleum projects. If high commodity prices are expected/assumed, this may cause a drive for adding volumes as we saw from 2005 and until the oil price slump in 2013. Enterprises in the petroleum industry reacted to the oil price fall by requiring robustness against low oil prices, putting more emphasis on reducing costs. New projects had to demonstrate low break-even prices, in terms of $/bbl, in addition to high NPV to become sanctioned.

The advent of shale oil in North America has highlighted the importance of yet another metric – the lead-time from investment decision to production. Motivated by the uncertainty about future oil prices and CO2-costs, investors now are looking for faster returns in addition to high value (high NPV) and robustness (low break-even).

More recently investors and enterprises have become increasingly concerned about the carbon footprint of their investments and operations. This is partly driven by an expectation of rising CO2-emission costs, and partly by stakeholders concerns for climate change and expectations for action.

A fundamental premise for operations is the acceptance in the society. This "license-to-operate" is fragile and is dependent upon the sector's ability to operate safely without major accidents and spills, and the ability to deliver on a credible roadmap for the industry's role in the energy transition.

Going forward we therefore believe that the competitiveness of the NCS depends on the ability to find, develop and deliver cost-efficient resources faster and with lower CO2-emissions.

The NCS competitiveness and the need for improvements is discussed over the next sub-sections for the following competitiveness contributors:

- Improved safety

- Reduction of GHG emissions

- Finding and maturing new resources (volumes)

- Attractive costs

- Lead times

Continual safety improvement in a time of change

The Norwegian oil and gas industry's ambition is to be world leading in health, safety and environmental performance. Returning safely from work and not experiencing work related health problems, is a value which is embedded in the zero-accident philosophy widely adopted in the industry.

Furthermore, accidents and work-related health problems have implications on business opportunities, revenue, and profit. Safety incidents harm companies' and industry's reputation and challenge the "license to operate", cause production down-time, and may erode shareholder value. Examples are numerous, ranging from small incidents like the accidental discharge of 1 m3 of hydraulic oil from the Eirik Raude drilling rig in the Barents Sea in 2005 causing a three-week delay and a dent in stakeholders' support to Barents Sea operations, to catastrophic accidents like the Macondo explosion, resulting in 11 fatalities, an oil spill of 780 000 m3, and company costs of more than 65 billion USD.

The zero accidents vision and the no harm principle set the ambition for HSE efforts. However, incidents, accidents, and exposure to working environment hazards still occur. To guide the industry in its endeavor to realize the vision, the principle of continuous improvement is widely applied.

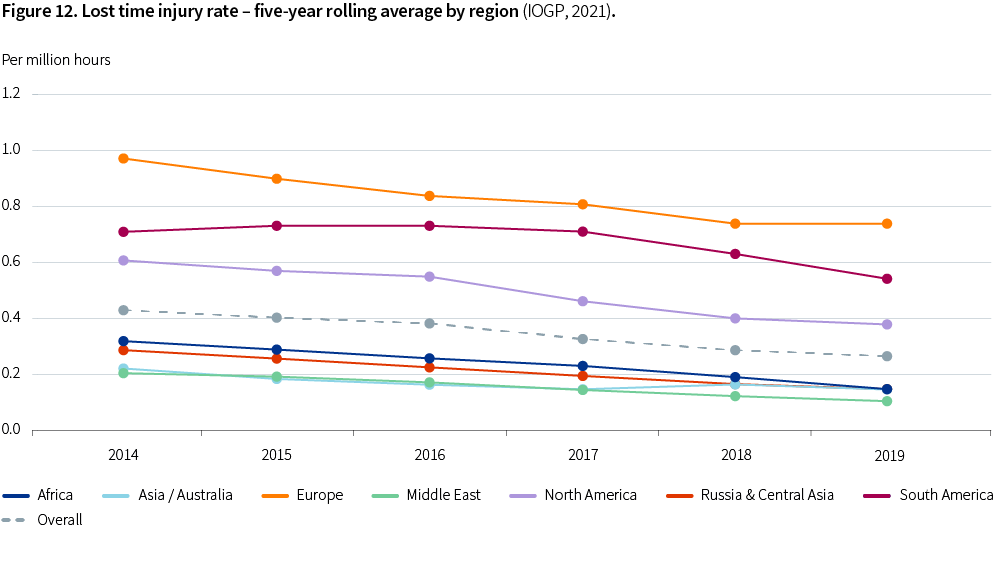

The HSE standards of the Norwegian petroleum industry are recognized to be among the highest in the world. One important reason for this is the continuous efforts made through the Norwegian tripartite cooperation between regulators, employer organizations and trade unions. As Figure 12 shows, this is surprisingly not reflected in international injury statistics collected by the International association of Oil and Gas Producers (IOGP, 2021), where European oil producing countries appear to have poorer lost time injury rate (LTIR) than other regions such as Asia, Russia and Africa where working environment regulations are believed to be less stringent.

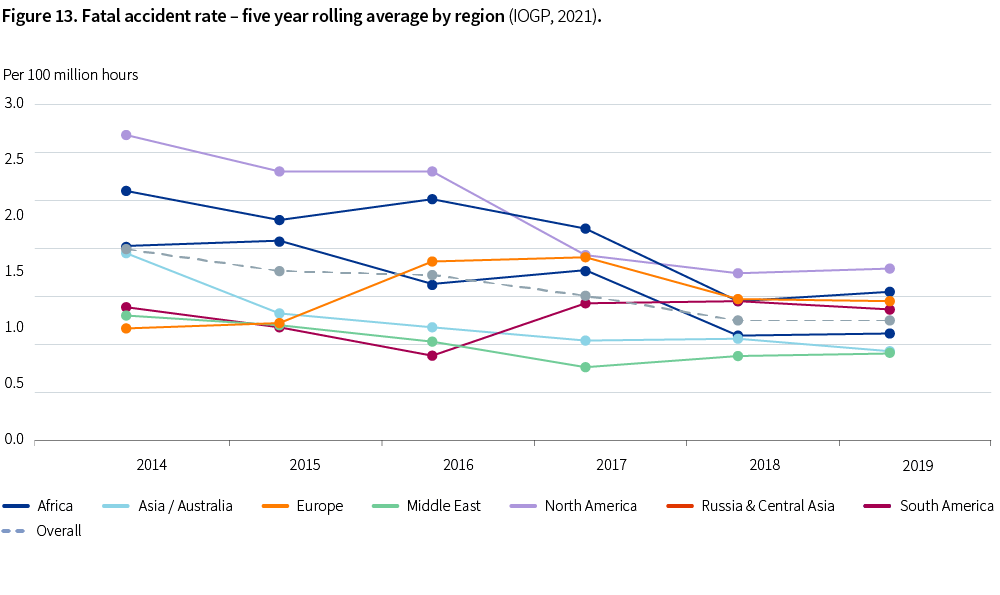

The apparently poor safety performance of the European region is less pronounced in the statistics on fatalities, see Figure 13, where the European region is in the middle of the investigated regions. We believe that the reporting accuracy increases with accident severity, and that the lack of correlation between LTIR and Fatal Accident Rate (FAR) numbers reflects diverging reporting practices rather than actual safety performance. OG21 has therefore not used the IOGP statistics as the basis for identifying safety gaps and measures, but instead used data and analyses from the Norwegian Petroleum Safety Authority (PSA) to discuss trends and improvement needs.

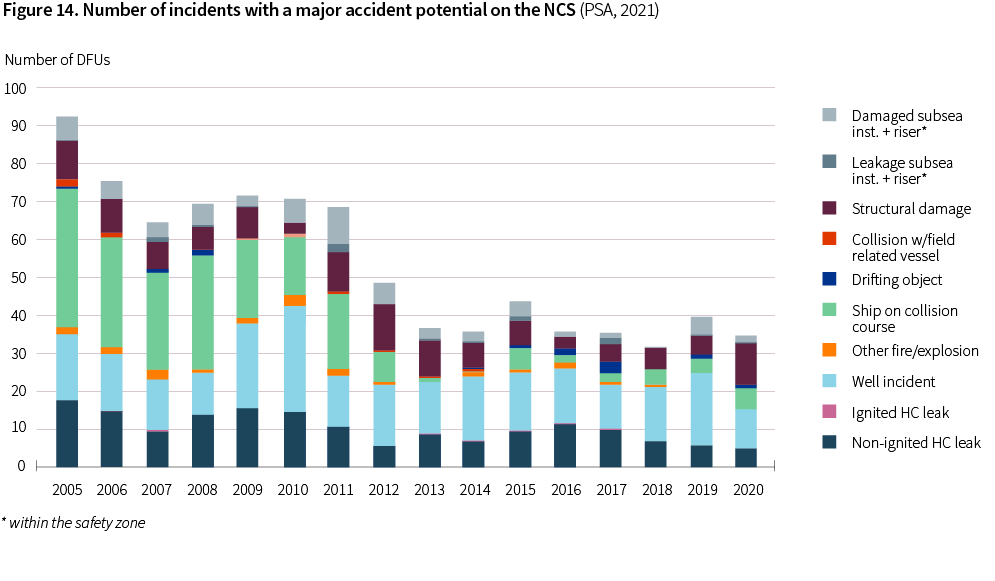

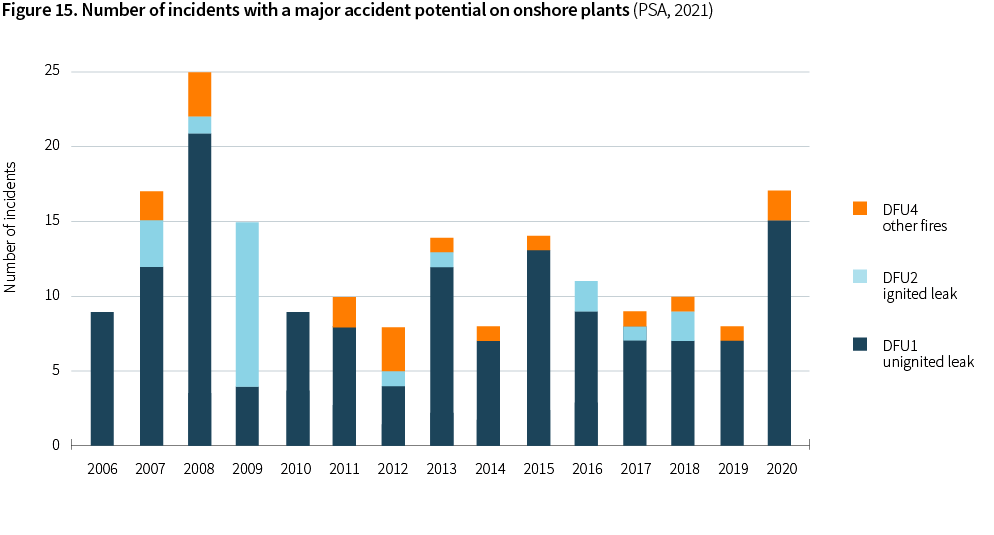

In the latest version of its report Risk level on the NCS (RNNP), the PSA concludes that the safety in the Norwegian petroleum industry remains high. The number of offshore incidents with a major accident potential is down, where especially the numbers of hydrocarbon leaks and well control incidents in 2020 were historically low, (PSA, 2021).

However, the trend on some indicators causes concern:

- A sharp increase in incidents with major accident potential at the onshore plants in 2020.

- A noticeable increase in structural incidents such as incidents involving dynamic positioning and mooring systems for mobile and floating installations, structural cracks, and waves on deck.

- Postponement of planned maintenance, especially the increase in maintenance backlog for HSE-critical equipment onshore.

- Negative trend in test results for safety-critical valves on offshore facilities.

However, it is important to state that the RNNP is a tool used to analyze trends over several years that require action or attention. Each report does provide a "snapshot" for a single year, but the formulation of R&D challenges and priorities is based on the trends observed over years.

The further development of the NCS to stay competitive on costs, volumes, emissions and lead times, will require efficiency improvements, where the introduction of digital technologies, new business models and work processes, are central elements. New technology and the accelerating pace of changes introduces new hazards and risks that will have to be managed in the spirit of the zero accidents philosophy.

A continual improvement of HSE performance requires management attention and prioritization, as well as improved understanding of HSE risks, hazards, and under-lying causes. OG21 has in Section 4.1 identified several areas where new knowledge and technology could contribute to a continued positive trend in HSE performance on the NCS.

Operational GHG emissions to be reduced

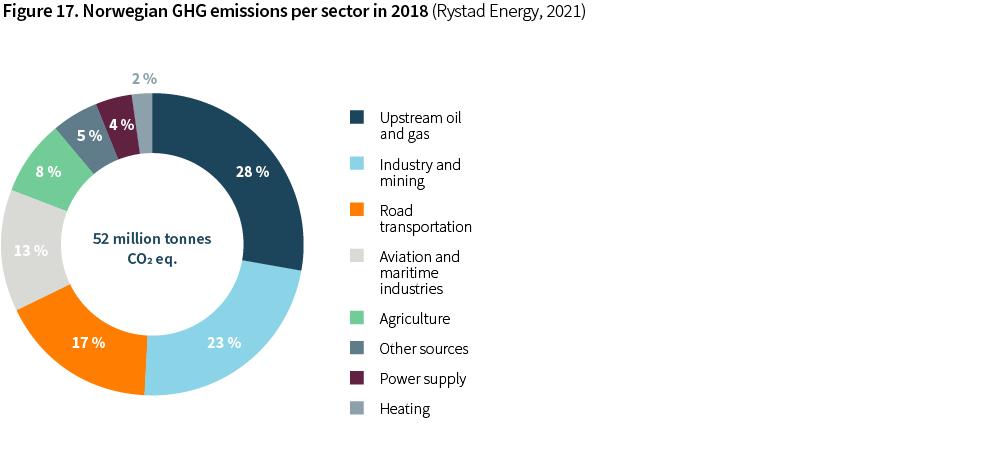

Greenhouse gas emissions (GHG) from the NCS production measured as kg CO2 per barrel produced (CO2-intensity), are the lowest among petroleum provinces globally, (Rystad Energy, 2021). This is largely a result of the ban on regular gas flaring introduced in 1974, and the introduction of a petroleum CO2-tax in 1991.

Still, the petroleum production is a significant contributor to the total Norwegian GHG emissions, as Figure 17 shows.

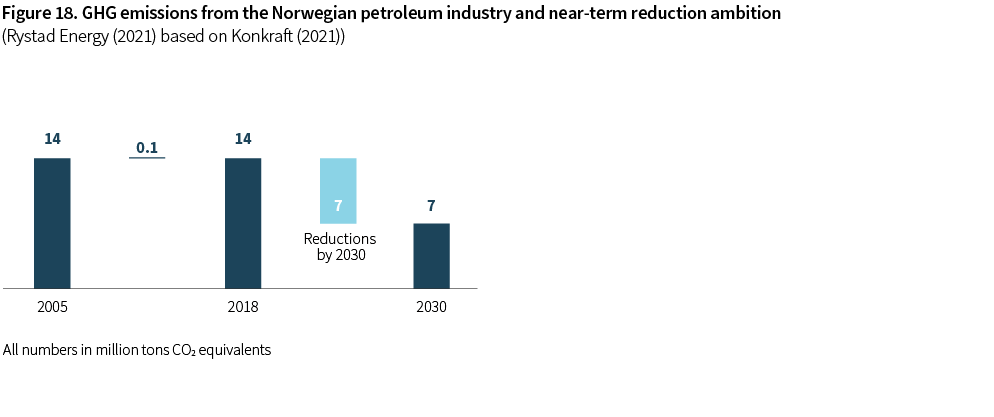

The Norwegian petroleum industry represented by the Konkraft collaboration, launched ambitious GHG emission targets in 2020 aiming for a 40% reduction in operational GHG emissions by 2030 as compared to the 2005 level, and further reducing the GHG emissions to near-zero by 2050. As part of the temporary tax changes for the petroleum industry agreed in the parliament in June 2020, the parliament asked the industry to further strengthen its 2030 target to a 50% reduction by 2030, see Figure 18. (Konkraft, 2021).

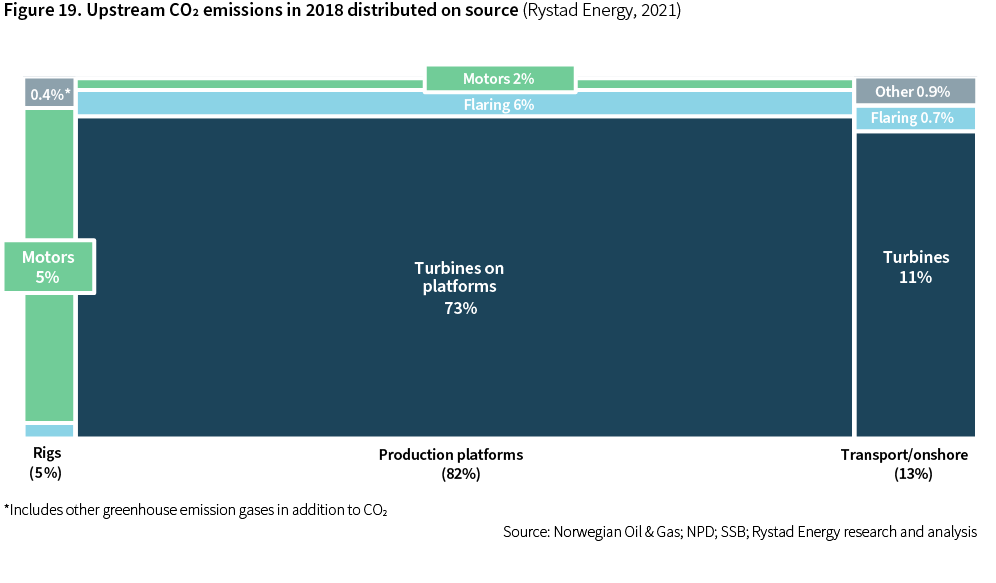

The main contributor to CO2-emissions on the NCS is turbines, generating energy for the operations, see Figure 19.

The turbines are combustion engines running on natural gas, with thermal efficiencies dictated by fundamental thermodynamic laws and the load characteristics. Without bottom-cycle or heat recovery, offshore gas turbines typically have thermal efficiencies in the 30-35% range. The alternative use of the gas in modern combined cycle power plants onshore have a thermal efficiency above 60%, with a corresponding reduction in CO2-emissions. In addition, capturing CO2 for sequestration would be easier on large onshore plants. The case for electrification of the NCS with power from shore based on the Norwegian power mix or from other renewables, is hence strong from a technical CO2 emissions perspective.

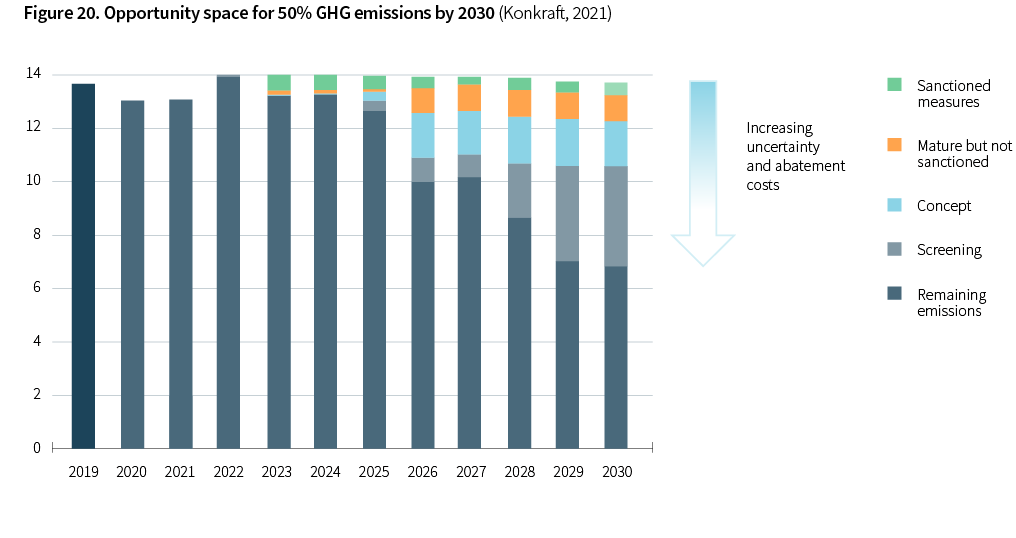

Konkraft has started the evaluations of how the 50% reduction ambition by 2030 could be met, see Figure 20. About 30% could be cut by projects already sanctioned and projects that are well matured, but not sanctioned, and a further 20% could be cut by projects currently in the concept phase. Approximately half of the necessary reductions would have to be cut by projects and measures that still need to be identified, matured and sanctioned.

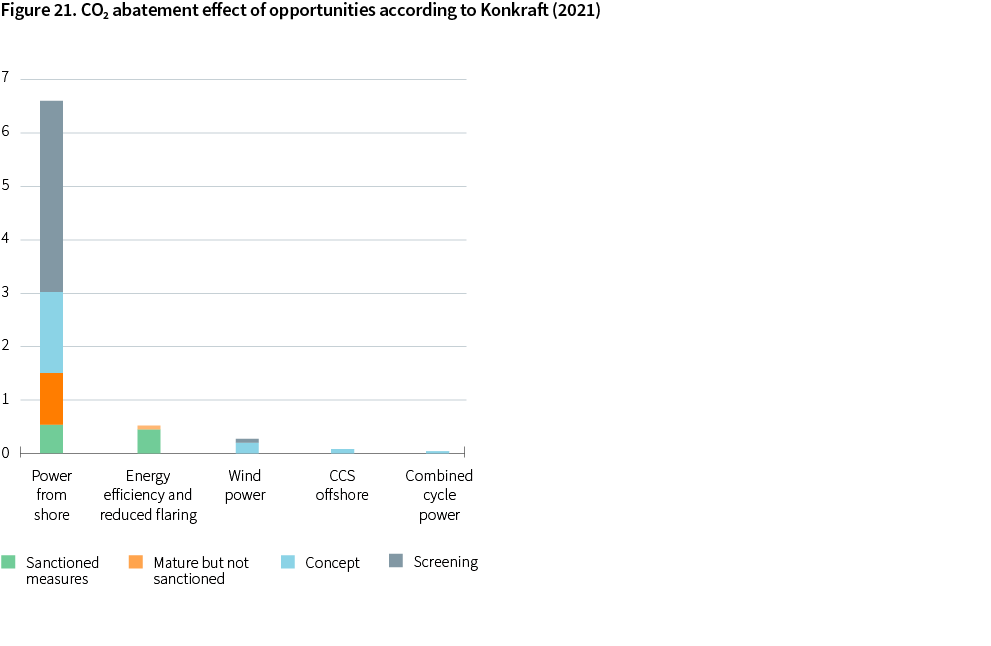

Figure 21 illustrates that electrification from shore is the most important measure to meet the 2030 ambition. However, energy efficiency, reduction of flaring, and wind power have also been identified as important contributors by Konkraft.

As producing fields mature, their CO2-intensity can be expected to increase unless measures are taken. Such measures include tie-back of new resources to increase the denominator in the metric, reduced water production through better reservoir drainage solutions or water separation downhole or on the seabed, and improved energy efficiency topside. Such measures, and other technology opportunities that could contribute to bring down GHG emissions, are described in Section 4.

The GHG emissions from the consumption of hydrocarbons is considerably higher than the emissions from the production. This does not mean that production emissions are not important. Firstly, the NCS production emissions are a major contributor to national emissions. Secondly, as oil demand over time is reduced in the transportation sector due to electrification or substitution with low-carbon fuels, an increasing portion of the carbon will be locked in petrochemical products, which increases the relative importance of production emissions.

A maturing NCS with many small discoveries, substantial resources in existing fields and still the opportunity for large discoveries

3.4.1 Many discoveries on the NCS, but the average size is decreasing

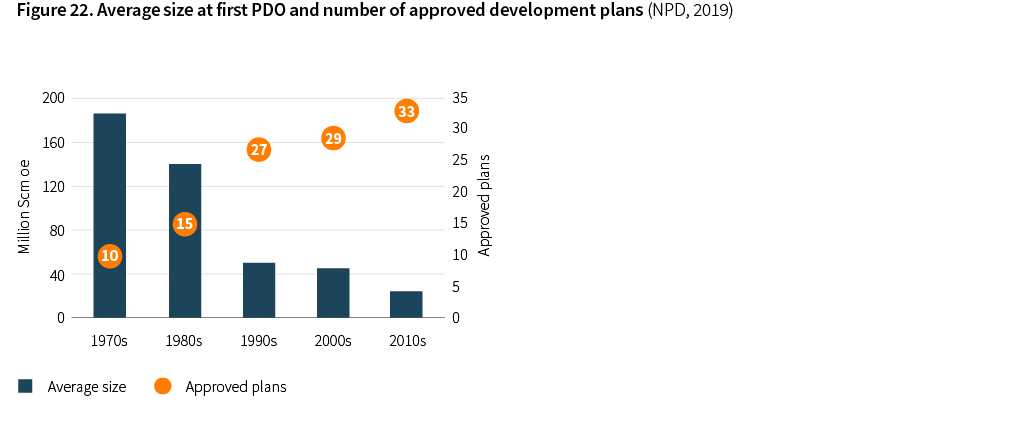

The NCS is maturing, which the average field development size per decade from the 70'ies and until today as shown in Figure 22, clearly indicates. At the same time the average number of field developments per decade has increased (NPD, 2019).

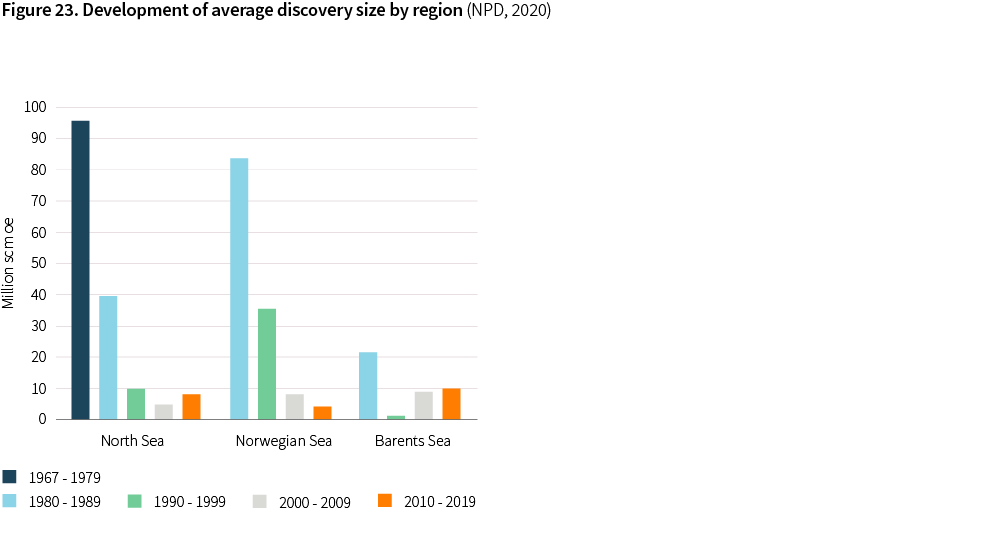

The large fields in the North Sea and the Norwegian Sea were mainly developed during the 70's and 80's, see Figure 23. With a few exceptions, notably the Johan Sverdrup field discovered in 2011, the discoveries and field developments have since then been relatively smaller. The Norwegian part of the Barents Sea is less explored, and a similar creaming curve for that basin is still not observed.

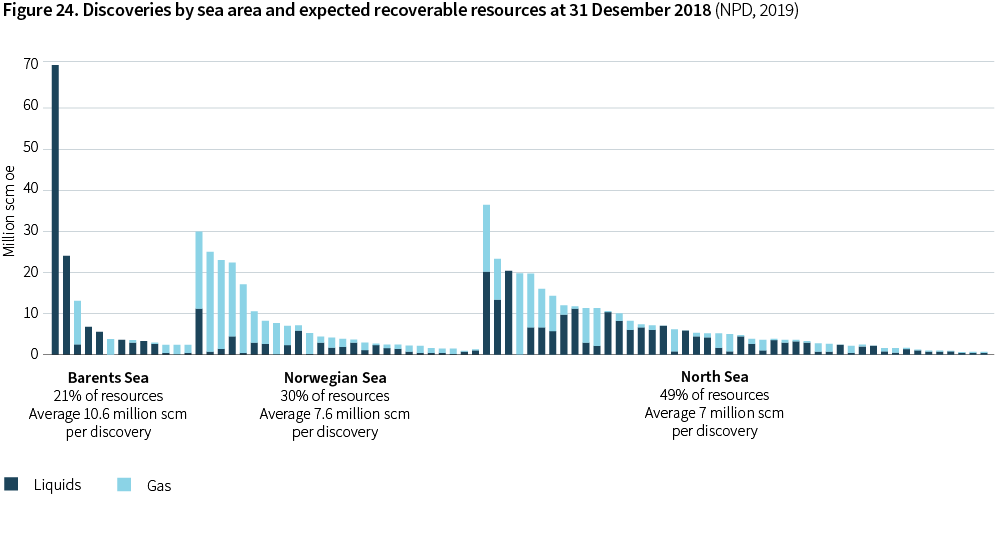

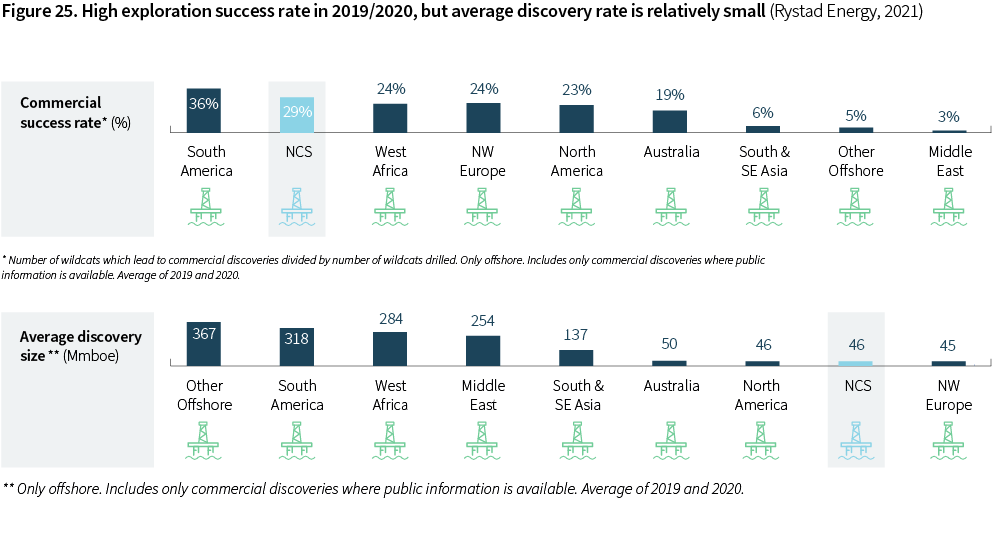

The NCS discovery portfolio in 2018 consisted of 85 discoveries with an average size of 49 million boe (NPD, 2019). The average discovery in 2019 and 2020 was approximately of the same size, see Figure 25. The average discovery on the NCS is small compared to many other provinces in the world, but the exploration success rate is high.

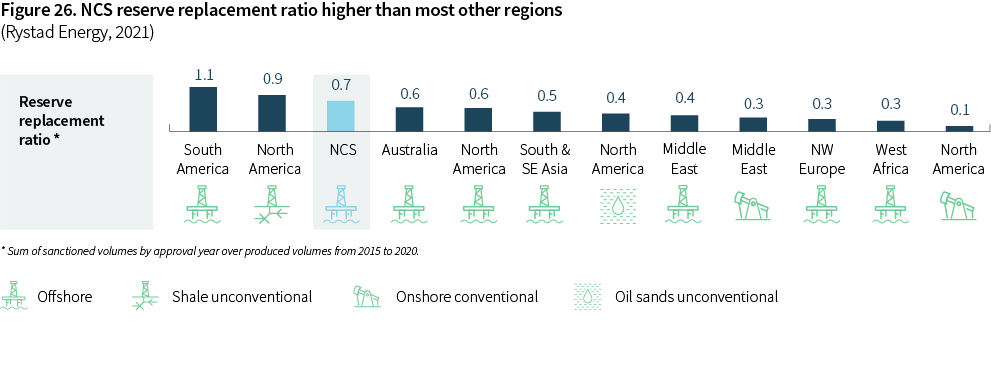

With a reserves replacement ratio (RRR) of 0.7, new discoveries on the NCS have not been able to replace the production over the last 5 years, as Figure 26 shows. In a global context, the RRR is competitive though. The RRR does not reflect reserves growth in existing fields.

3.4.2 Existing infrastructure key to further NCS development

Existing infrastructure is key to the further NCS development:

- Realizing the large contingent resources in existing fields, indicated in Figure 2 in Section 4.

- Realizing the large portfolio of smaller discoveries that would require tie-back to a host.

- It encourages further exploration in the proximity of potential hubs.

Contingent resources in existing fields are of the same magnitude as the contingent resources in the discovery portfolio. Historically, operators in collaboration with suppliers on the NCS have been able to realize such resources with great success.

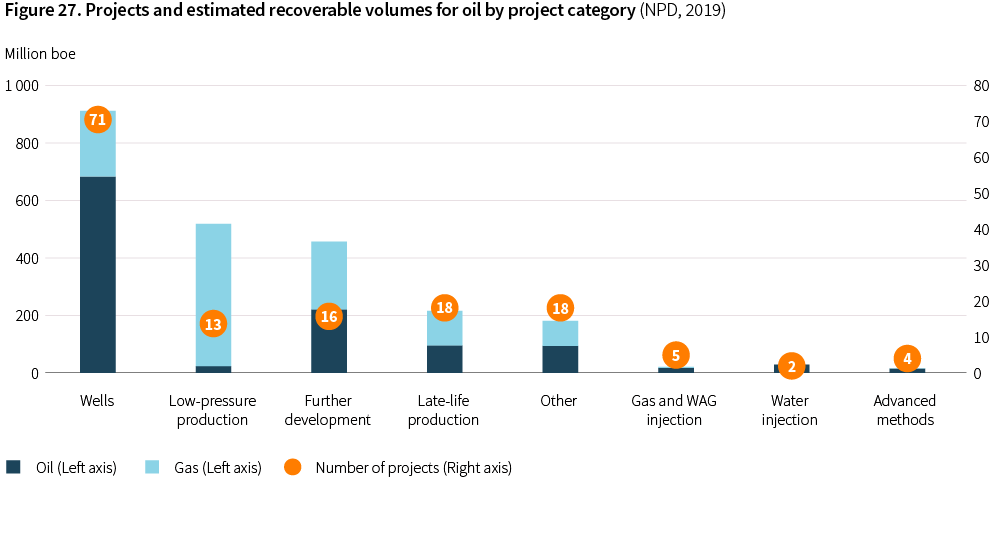

Looking forward, there are numerous projects in the pipeline that would improve oil recovery (IOR) from existing fields – Figure 27 shows specific but undecided projects reported to the NPD. Wells are the most important measure to realize new resources from existing oil fields, whereas low-pressure production is the measure that is favored for gas fields.

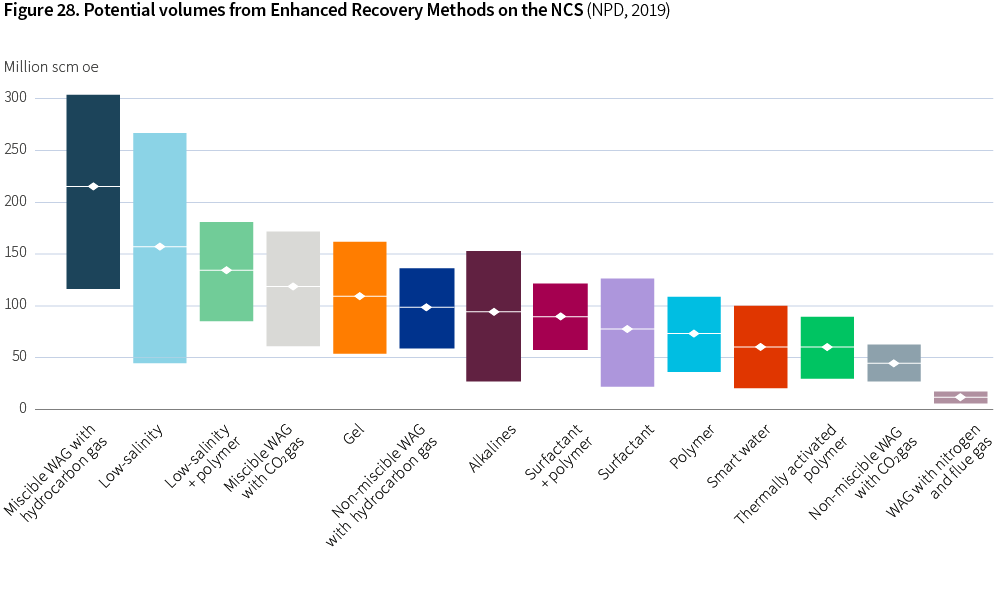

In addition, there is a substantial potential for improved recovery related to more advanced methods, the so-called Enhanced Oil Recovery (EOR) methods, see Figure 28. The figure presents the scaled potential for specific EOR methods summed up for 27 discoveries and fields included in an NPD study on the EOR potential (NPD, 2019). The scaled potential reflects operational criteria as well as economics.

Despite the potential large volumes such measures could provide, there are only few projects currently being considered, as Figure 27 shows.

IOR and EOR methods can provide large added volumes. When it comes to investment decisions, many of the methods fall short because of either high costs and/or high GHG emissions.

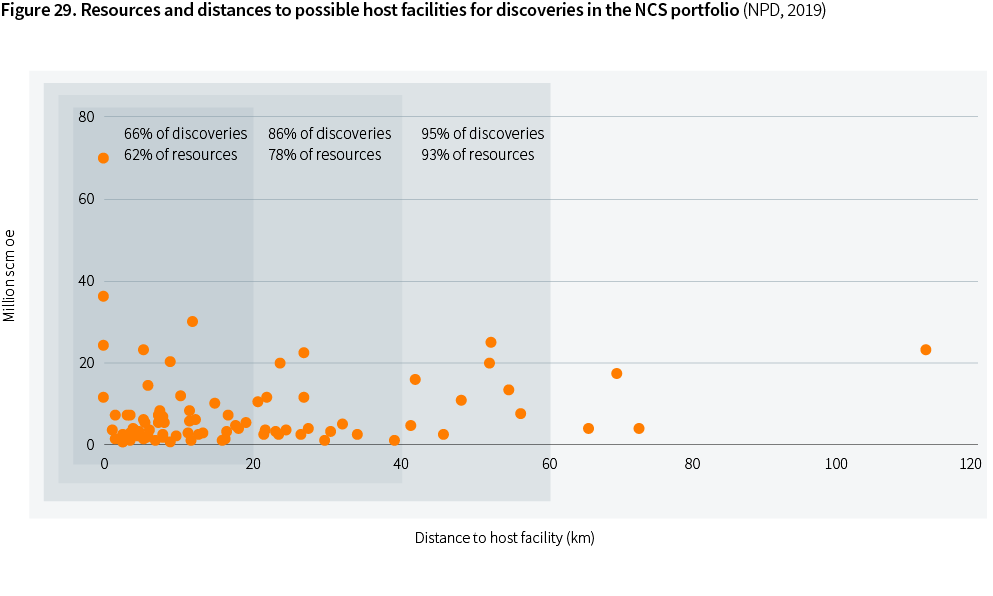

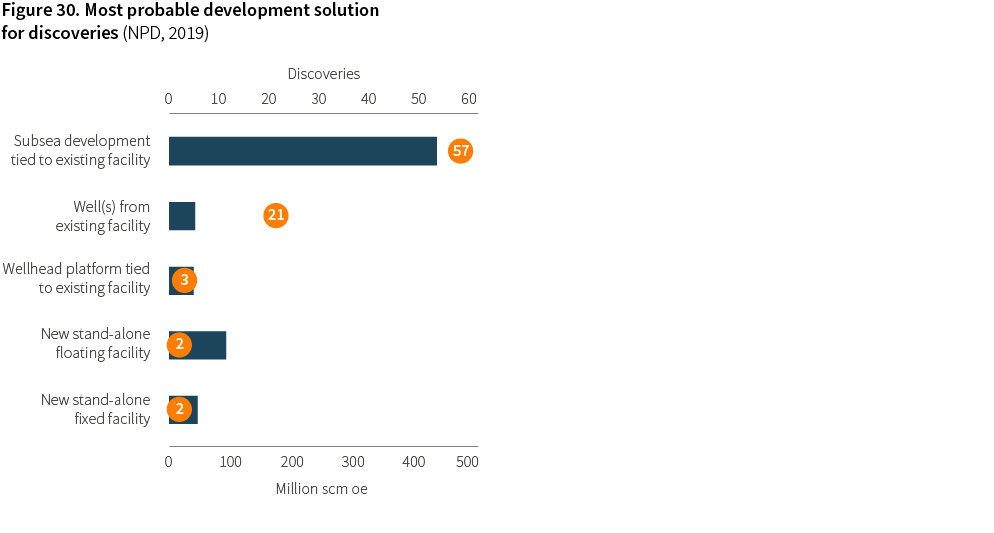

Most of the 85 discoveries in the NCS portfolio are too small to justify stand-alone developments, and would therefore require tie-back to existing infrastructure to become realized, as Figure 29 suggests. 86% of the discoveries are within a 40 km distance to a possible host discovery. Only 4 of the 85 discoveries are further than 60 km away from a potential host facility.

The size distribution of the discoveries and the proximity to potential host facilities, illustrate the importance of efficiently utilizing existing infrastructure for the further development of the NCS (NPD, 2019).

Realizing more resources on the NCS is a cross-functional task involving subsurface, drilling and well, and facilities disciplines, in close collaboration with safety and external environmental groups. This is reflected in the OG21 technology priorities described in Section 4.

A continued high attention to cost is required to stay competitive

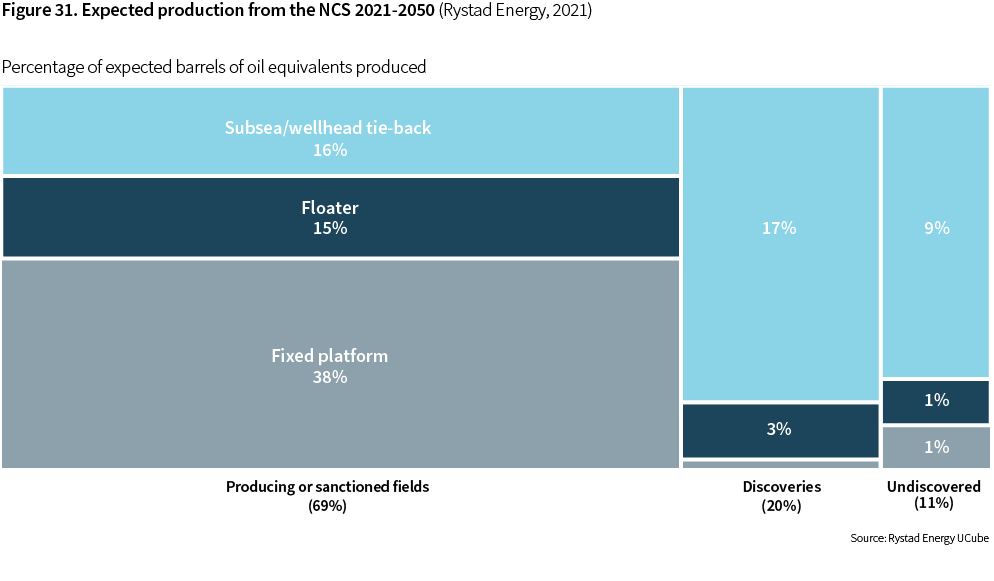

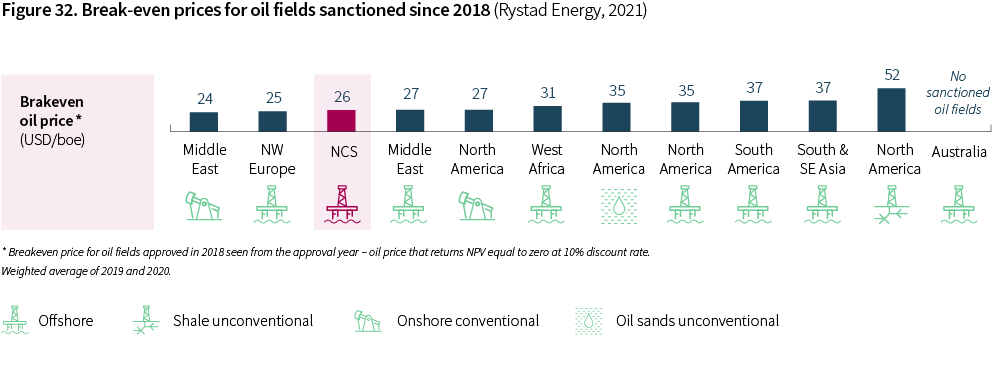

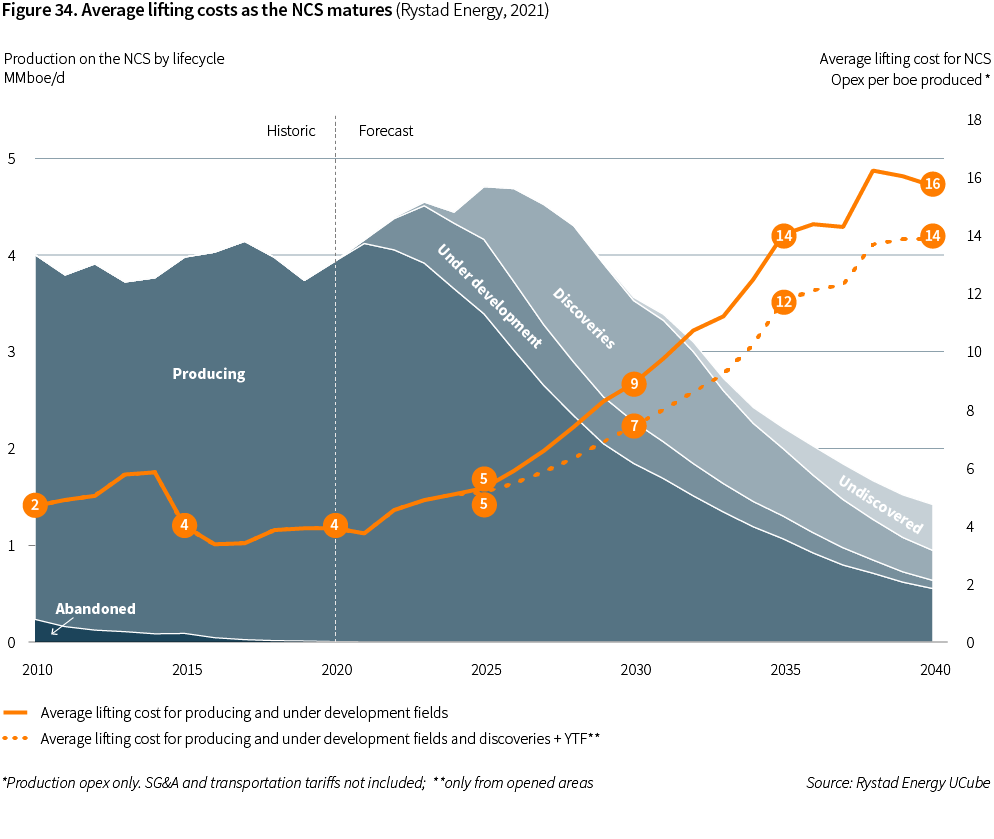

Break-even prices on the NCS are currently competitive compared to other oil provinces (Figure 32). As Figure 33 indicates, this is mainly due to low operational costs, which again is caused by a cost-efficient infrastructure well suited for development of new resources in the fields or near-field tied back to hubs.

Although exploration costs (Expex) and capital costs (Capex) for new projects have come down considerably since 2014, Figure 33 clearly shows that Expex and Capex on the NCS are relatively high compared to the competition.

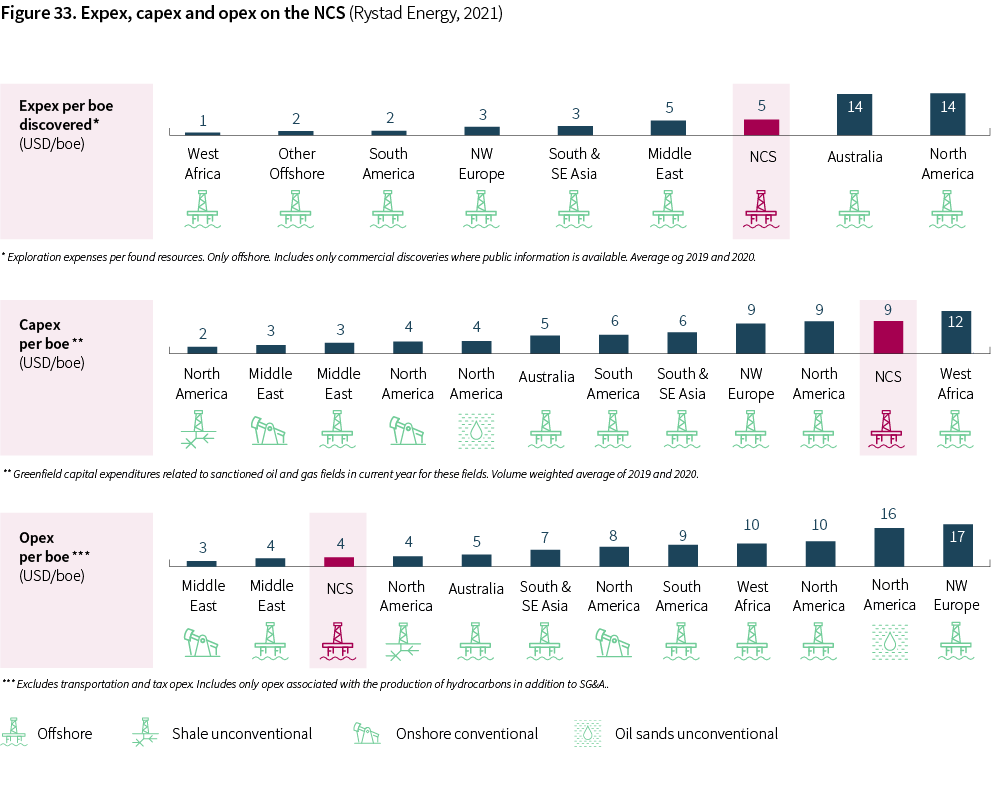

To further underline the generic cost challenge, the currently favorable Opex level on the NCS contributing to the low break-even price, cannot be taken for granted. Operational costs remain largely at the same absolute level for an installation throughout its lifetime, and as the production from a field declines, the average lifting costs per barrel increase. Figure 34 illustrates this on an aggregated level for the NCS.

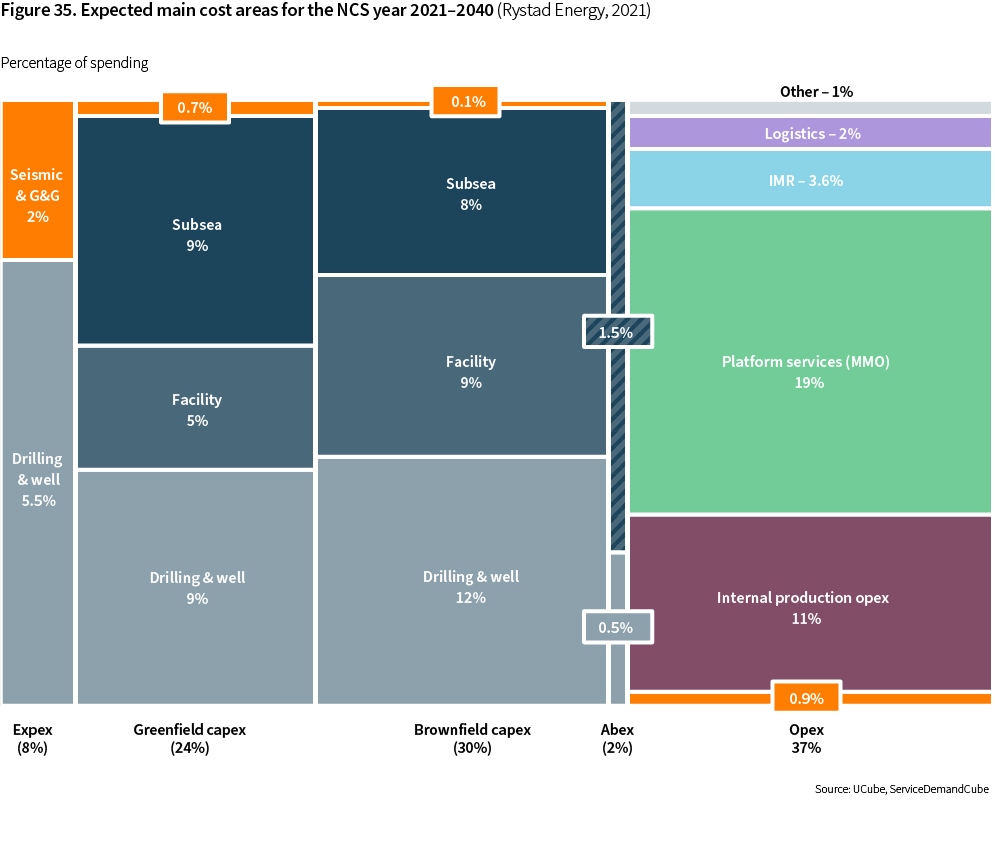

As Figure 35 illustrates, we expect four main cost areas over the next two decades:

- Drilling and well (28%)

- Facility capex (14%)

- Platform service and maintenance (19%)

- Subsea capex (17%)

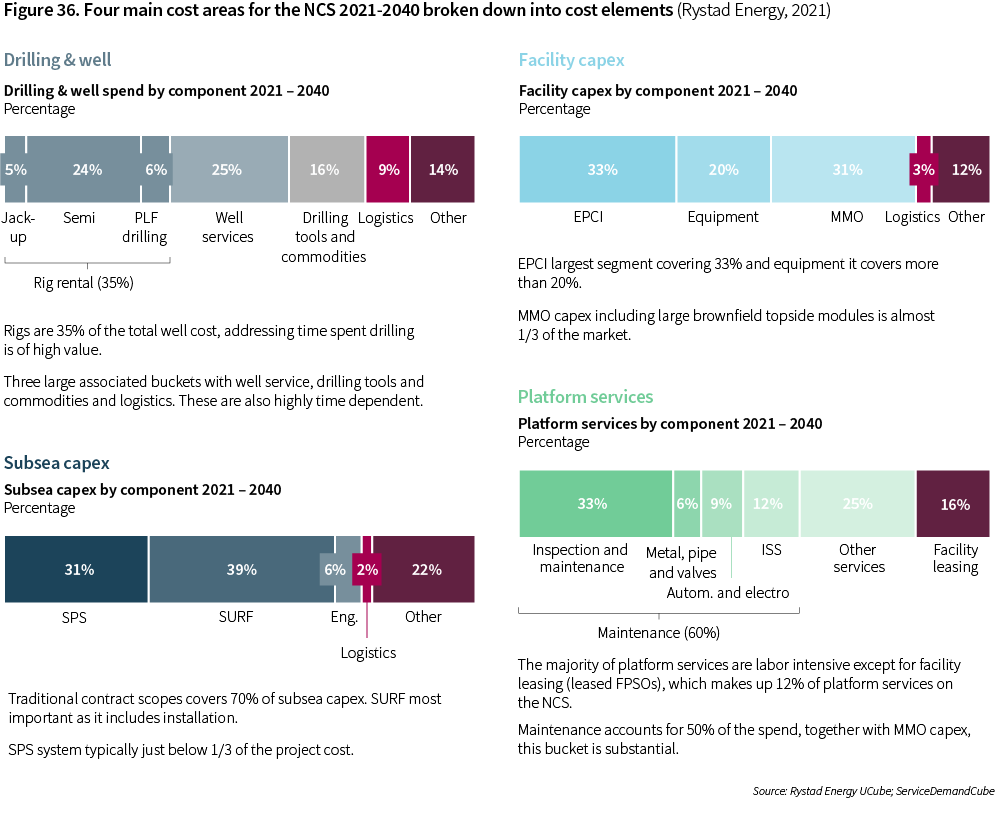

A deeper dive into the expected four main cost areas is shown in Figure 36.

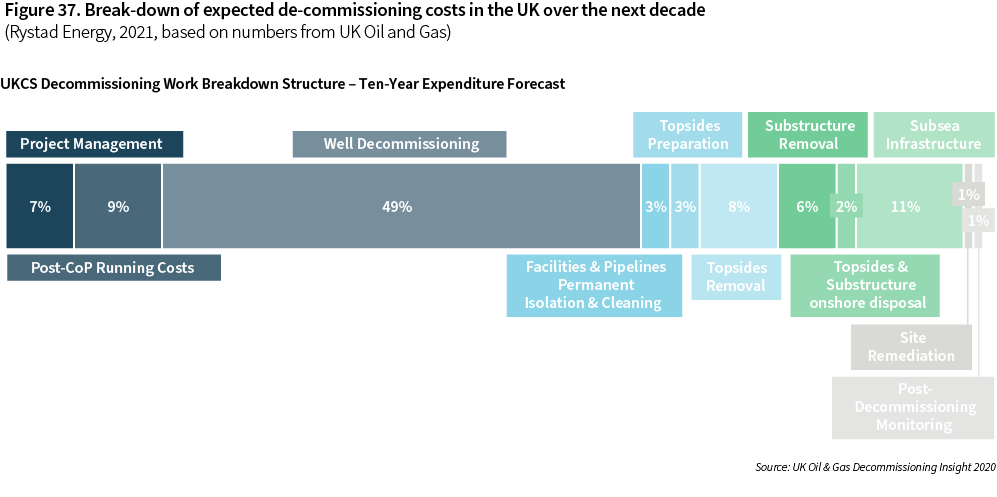

De-commissioning costs is a growing concern on the NCS. Many fields approach the end-of-life, and wells will have to be plugged and facilities removed. UK numbers suggest that plugging and abandonment of wells (P&A) contribute with 49% of de-commissioning costs, whereas removal of facilities, site remediation and monitoring combined contribute with around 34% of the costs.

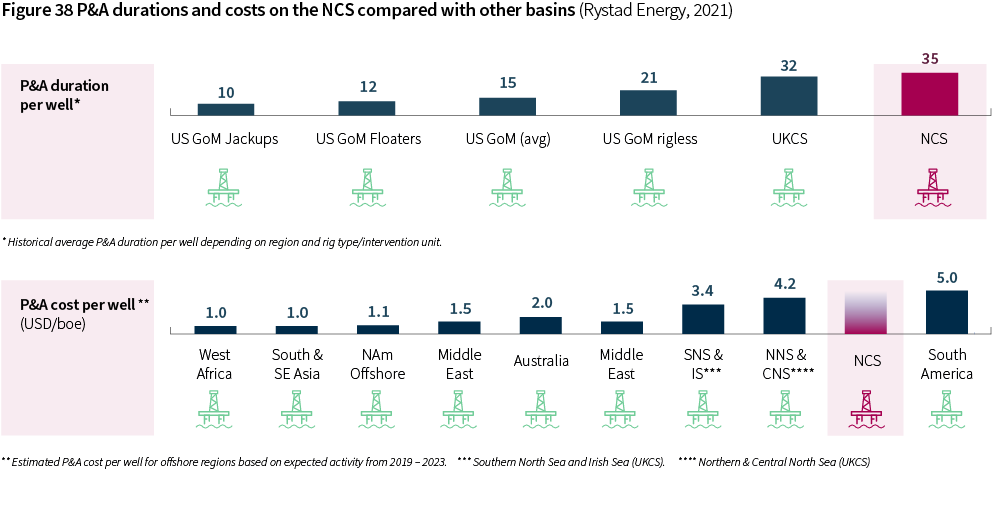

More than 3000 wells are going to be plugged and abandoned safely on the NCS over the next decades. A typical P&A operation on the NCS takes 35 days with the use of a mobile drilling unit. This is longer than P&A operations in other offshore petroleum provinces and it drives costs. More efficient P&A methods in addition to methods that would allow lighter vessels to be used for P&A, would have the potential to reduce costs considerably.

Utilizing and extending the life of existing infrastructure contributes to cost-efficient development of new fields in the vicinity. This has a positive effect on NPV as some de-commissioning costs are moved into the future. An alternative use of facilities when the field approaches late-life or even after production has shut down, could have the same effects.

The cost challenge on the NCS remains high in all phases: exploration, field development, production and operations, and de-commissioning including P&A. Bringing costs down is an important driver behind the development and implementation of new technology for all these phases, as the discussion of OG21's technology priorities in Section 4 shows.

Reduction of lead time increasingly important

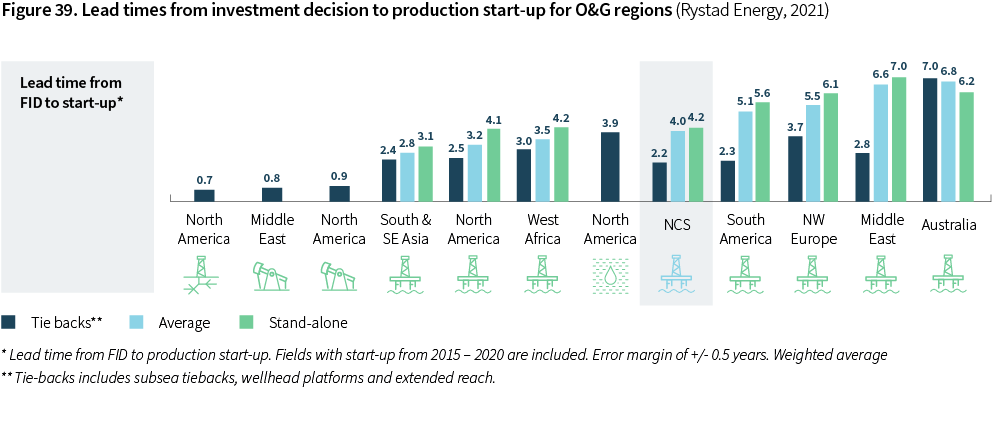

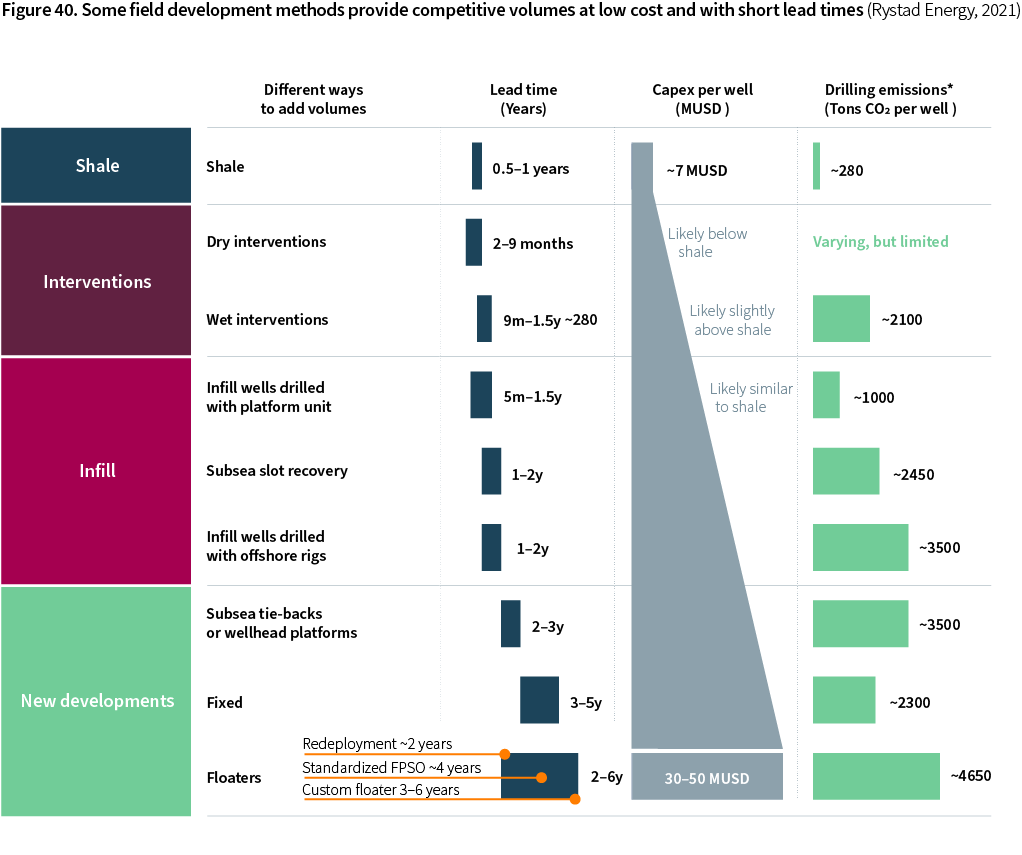

The lead time, measured as time from investment decision to production starts, is an increasingly important parameter when sanctioning new investments. Shorter lead times reduce uncertainties related to product prices, costs for emitting GHG gases, and policy development.

Onshore developments within conventional and shale stand out as the projects with the lowest lead times. The NCS is on the average compared to other offshore provinces on this metric. However, tie-backs to hubs, which is a very important field development solution on the NCS, compare very favorable to other offshore regions.

Some field development methods on the NCS offer lead times that are at par with the best industry performance. Well interventions and infill wells are examples that provide volumes with lead times ranging from months to less than 2 years.

When considering new technology, the ability of the new technology to reduce lead time and accelerate production should be included.

Technology and knowledge needs

Overview of technology priorities for all disciplines

The overarching goal of technology development and implementation is to realize value from the NCS safely and with minimal environmental impact.

The OG21's technology groups (TGs) have identified new technology and competence that could improve the NCS competitiveness in light of the future demand for oil and gas described in Section 2 and the challenges and opportunities described in Section 3.

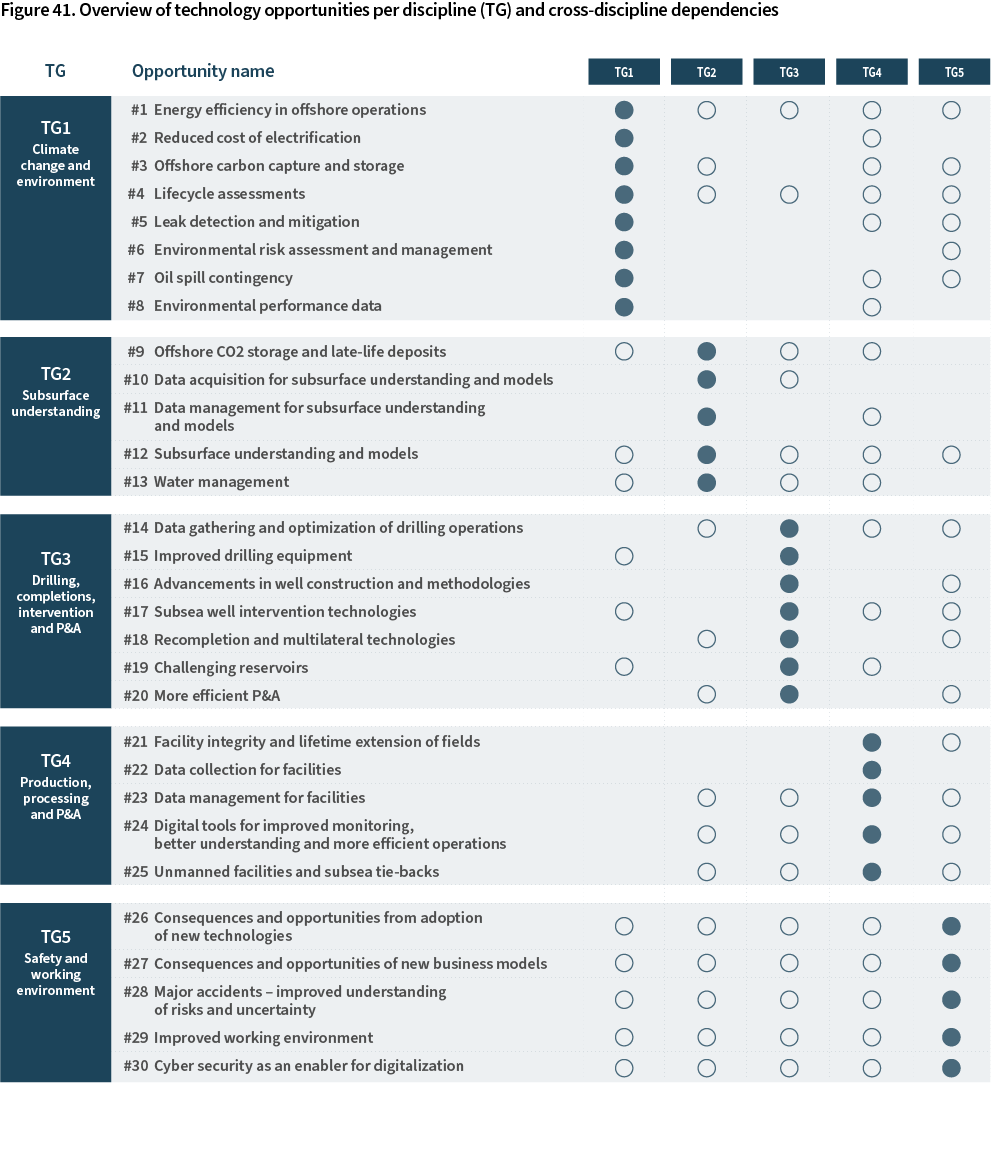

A total of 30 technology and knowledge areas have been prioritized. In addition, the TGs have discussed and identified opportunities for new industry development based on the competence and solutions in the petroleum industry as well as opportunities for improved life-cycle management and circular economy.

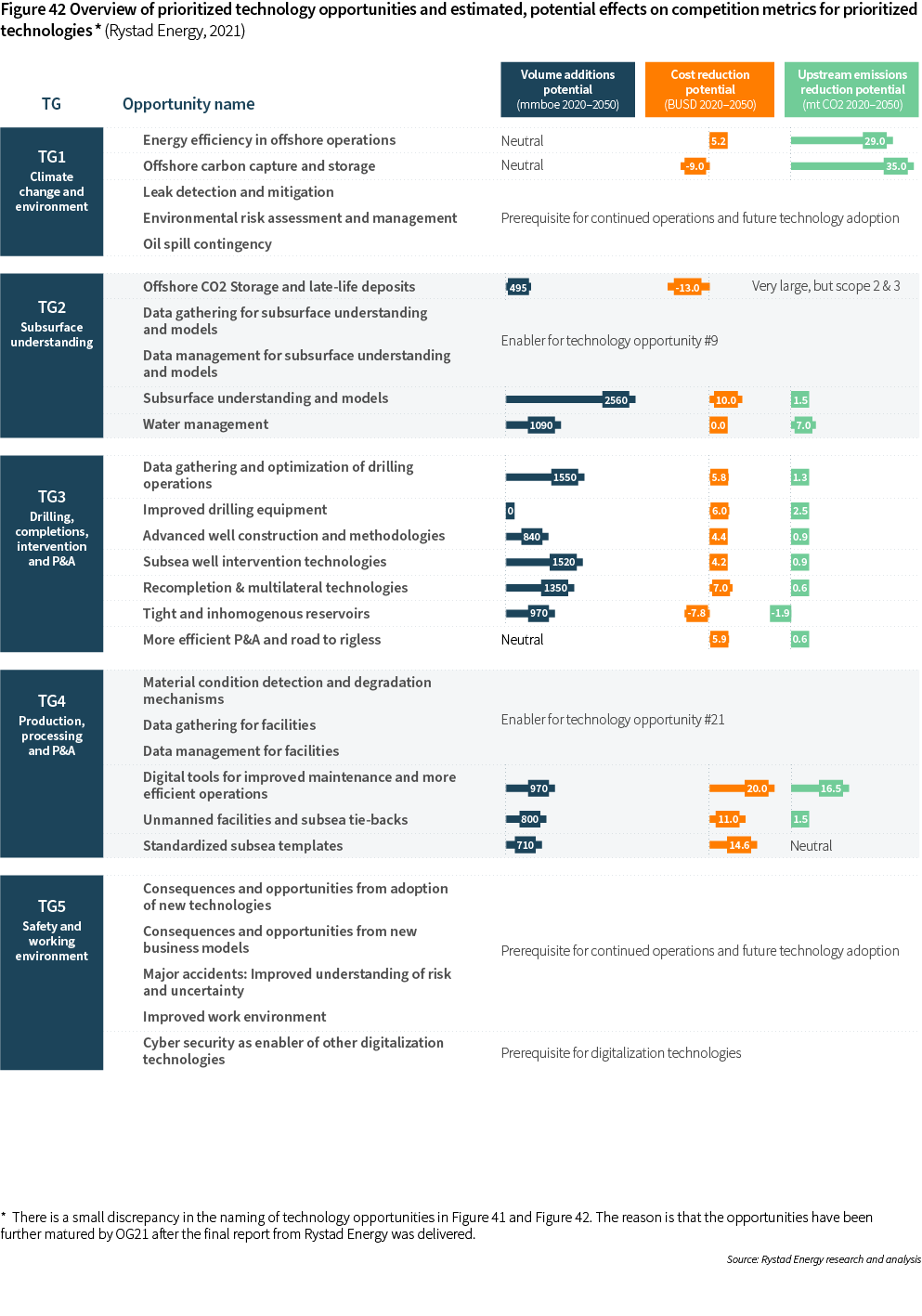

An overview of the technology priorities per discipline (TG) and interconnections between disciplines, is shown in Figure 41. Estimates on potential value for technology opportunities is presented in Figure 42. A detailed description of the prioritized technology areas for each TG is provided in the following sub-sections.

As Figure 41 indicates, a broad range of technologies is needed to improve the NCS competitiveness. Each prioritized technology area offers significant improvements on at least one of the competition metrics. Combined, the prioritized technology areas hold a promise of improving the NCS competitiveness along all metrics, including volumes, costs, and CO2-emissions.

The prioritized safety and environment technology areas are fundamental for the "license-to-operate". Addressing the technology and knowledge needs within these areas is therefore of vital importance for the further development of the NCS.

Stakeholders in the petroleum sector have a shared responsibility for addressing the technology priorities through R&D&I, and OG21 therefore encourage industry enterprises, universities, research institutes as well as public funding bodies, to reflect OG21 priorities in their R&D&I plans and programs.

We have not indicated current TRL-level for the prioritized areas. The reason is that even for prioritized areas where mature technologies exist in the market, there is still scope for radical new innovations, new components or new knowledge that could replace or improve existing solutions.

Safety and working environment

The NCS and the Norwegian petroleum industry compete in global markets. To stay competitive the industry needs to become more cost-efficient, successfully explore and develop new resources, reduce lead times, and significantly reduce GHG emissions as discussed in Section 3. But at the same time, a high safety level must be achieved to maintain support in the society.

The strive for improved competitiveness for a maturing oil province as the NCS introduces safety risks that must be managed, e.g.:

- An aging infrastructure which requires more inspection and maintenance.

- New inspection and maintenance philosophies and technologies.

- New digital technologies like remote operations and autonomy.

- New low-carbon technologies and energy carriers like hydrogen and ammonia.

- A changing operator landscape with fewer large international companies and more medium sized and small independent oil companies.

- New business models and contract models where contractors and suppliers are integrated with operators.

- Increased integration of digital systems and technologies that could render the systems more vulnerable to cyber security threats.

These risks have been the considered when TG5 has prioritized technology and knowledge areas. The prioritized technology and knowledge areas for TG5 are:

- Consequences and opportunities from adoption of new technologies.

- Consequences and opportunities of new business models.

- Major accidents: Improved understanding of risks and uncertainty.

- Improved working environment.

- Cyber security as an enabler for digitalization.

An important principle on the NCS is that changes shall provide at least the same level of safety as prior to the changes. Understanding the safety and working environment consequences of introducing new technology is hence important. We need an improved understanding as well as improved safety risk management of the potential safety and working environment hazards of all types of new technologies being considered for implementation. This includes the technology needs identified by the other OG21 Technology Groups.

The same principle also applies to organizational and structural changes. It is therefore important to improve the understanding of how the changing NCS operator landscape as well as new collaboration models such as strategic alliances between operators, suppliers, and service providers, influence safety and the working environment.

Petroleum operations involve safety risks. The industry works continuously to identify hazards, and understand, reduce, and mitigate risks. To improve, the industry needs to further develop the understanding of risks including how to manage the inherent uncertainty that risks are associated with. This particularly applies to major accident risks. Improvement areas include for instance better integration of human factors in risk management tools, and improved systems for learning from the past.

The precautionary principle should be applied when the consequences of activities are uncertain or unknown. There is a continued need to better understand the physical, chemical, social, or the psychological work environment of ongoing activities. Likewise, such working environment factors should be investigated also when new technology and new work processes are implemented.

The cyber-security area addresses an imminent and rapidly increasing threat to the industry. The industry is progressively making use of digital solutions in numerous new areas. As new digital technologies are implemented and industrial operational systems are becoming more integrated with other information technology systems in enterprises, the design and management of barriers becomes more complex. There is a need to better understand safety implications of new infrastructure complexities and threats, as well as the vulnerability of data and applications. Furthermore, it's important to strengthen the national cyber security competence and the situational awareness on such issues in the Norwegian petroleum industry. The industry is dependent upon a digital transformation to stay competitive, and managing cyber-security threats efficiently, is fundamental to this transformation. In this context it should also be noted that improved management of information and communication technology (ICT) security has a potential large transfer value to other disciplines.

Environment and greenhouse gas emissions

The prioritized technology and knowledge areas for TG1 are:

- Energy efficiency in offshore operations.

- Reduced cost of electrification.

- Offshore carbon capture, utilization and storage (CCUS).

- Lifecycle assessments.

- Leak detection and mitigation.

- Environmental risk assessment and management.

- Oil spill contingency.

- Environmental performance data.

The first three are addressing the need for reducing CO2-emissions from the NCS, described in Section 3.3; whereas lifecycle assessments look at assessing environmental impacts beyond the NCS geography (supply chain etc.). The next three are related to the “zero harm” vision and drive for continual improvement described in Section 3.1 and 3.2. The final point looks at the coverage of and access to data which describes environmental performance.

Technology development includes development of knowledge. The technology strategy emphasizes the need for improved knowledge, improved risk understanding, and corresponding mitigating actions to ensure a sustainable effect on the environment from the oil and gas activities.

Implementation of new technologies might affect risk. Technology development within the environment and greenhouse gas emission perspectives will need to consider its possible impact on safety by ensuring an integrated risk assessment of possible technology solutions.

Subsurface understanding

The prioritized technology and knowledge areas for TG2 are:

- Offshore CO2 storage and late life deposits.

- Data acquisition for subsurface understanding and models.

- Data management for subsurface understanding and models.

- Subsurface understanding and models.

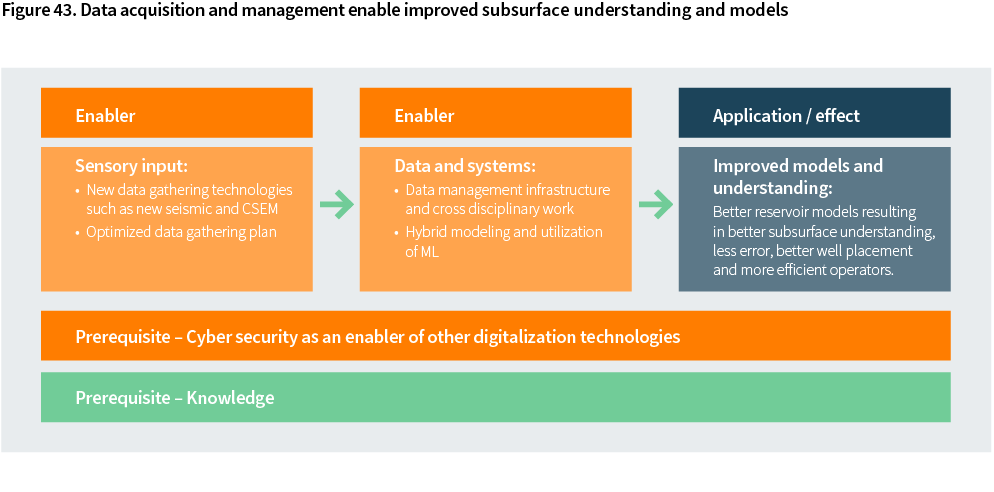

- Water management.

The "data acquisition" and "data management" technology areas, described in detail on the next pages, are enablers for the "subsurface understanding and models" technology area. This is shown in the figure below.

The TG2-prioritized technology areas are important for all the competition indicators described in Section 3.

For instance, the improved subsurface understanding and models, building on data acquisition and the management related to it, will provide the fundament for:

- Finding and maturing new resources.

- Cost-efficient reservoir drainage.

- Safe and cost-efficient drilling.

Offshore CO2 storage has, in addition to receive and store large amounts of CO2 from industry sources in Norway and abroad, the potential to extend the lifetime of fields beyond the cessation of O&G production.

Improved water management will lead to significant reductions in water cycling, and thereby lower emissions from power generation. It is also expected that improved water management will accelerate HC production and yield higher resources by a more efficient reservoir drainage, as well as savings related to less energy consumption for processing of both injection and produced water.

Drilling, completions, intervention, and P&A

Although drilling performance has improved substantially over the last 6 years, Drilling & Wells is still the main cost element on the NCS, representing 28% of estimated expenditures on the NCS for the 2021-2040 time period (Rystad Energy, 2021).

The prioritized technology and knowledge areas for TG3 are:

- Data gathering and optimization of drilling operations.

- Improved drilling equipment.

- Advanced well construction and methodologies.

- Subsea well intervention technologies.

- Recompletion and multilateral technologies.

- Challenging reservoirs.

- More efficient P&A.

All TG3-priorities have the potential to cut costs on the NCS significantly (see Figure 42). In addition, most would contribute to adding significant volumes. Most of the priorities would also have a potential positive impact on CO2-emissions.

"Challenging reservoirs" are with current technologies associated with higher CO2-emissions than conventional reservoirs. Considering the large volumes on the NCS in such reservoirs, the R&D efforts should be aimed at reducing CO2-emission to at least the same level as for conventional reservoirs. We believe such reservoirs could potentially be drained with technologies that are not necessarily very energy consuming, e.g. more mechanical technologies can be developed, and fluid pumping methods could be advanced.

Common for most of the evaluated TG3 priorities is that they can be adopted fast – often they would yield saved costs or added volumes within a year from investment decision. This make such technologies especially attractive in a business environment where fast returns are favored and may explain why such technologies had a relatively high adoption rate during the petroleum recession period 2014-2018.

We have seen some technology development for rig equipment over the last years, but there is still scope for further improvements. Making use of sensor data and Artificial Intelligence (AI) to improve automation and make the rig operate more towards optimum performance every time, will improve the efficiency and as such minimize the carbon footprint of the operation. This combined with improved and modernized drilling equipment has a considerable potential.

When it comes to well construction, new drilling methods and optimized well design combined with intelligent utilization of existing wells have been demonstrated by some of the operators on the NCS. There are however several new technologies where the full potential is still not harvested. Further development and adoption of such technologies could reduce the number of days per well, and facilitate cost and volume optimized wells, i.e. maximizing the value of each well.

P&A of wells on the NCS is a considerable challenge ahead. We need step change technologies to make these operations as effective as possible to minimize future expenditures. The market volume is increasing, and several service companies are very creative in this arena and should be stimulated to advance these technologies to minimize rig days, emissions, and costs.

Production, processing, and transport

Remaining contingent resources on NCS as presented in Figure 2, are almost equally distributed between contingent resources in existing fields and contingent resources in the NCS discovery portfolio. Average size of discoveries is decreasing, but most discoveries are within tie-back distance to existing fields, as shown in Figure 29.

The NCS is characterized by very efficient infrastructure which is the main reason behind favorable operational costs and break-even prices presented in Figure 32 and Figure 33. However, as production declines from existing fields, costs per barrel increase unless more resources are produced.

Cost-efficient continued development of the NCS is therefore dependent upon two success factors in particular:

- Efficient utilization of the existing infrastructure to realize contingent resources in the areas.

- Realization of discoveries through tie-backs to existing infrastructure.

Making a step-change in cost effectiveness for subsea solutions will enhance tie-in economy and hence provide a great impact on the ability to lift additional volumes from near-field discoveries and prospects. With the high number of potential tie-in projects going forward, there is a great advantage to standardize on new subsea technologies to enable wide implementation with reduced unit costs.

Safe lifetime extension of existing installations is contingent on cost-effective documentation of present state with adequate quality. In this context, efficient development and implementation of sensors and tools, both physical and software, is important across NCS. Robotics with increased level of autonomy and advanced analytics including Artificial Intelligence can prove vital tools for documentation of condition, but also safe and efficient production while in operation.

Value of data is realized when used to update a risk picture, integrate into optimization schemes, or inform decisions to be made. Further, efficient data-collection will bring most value when systemized and coupled with domain knowledge on e.g. degradation mechanisms and prediction of future load and response. Such knowledge on both capacity and load side of offshore structures is important. Technologies improving management of information across all project development interfaces (research communities, contractors, suppliers, service providers, partners, manufacturers, integrator) is needed to improve efficiency in engineering, construction, operation/maintenance. This calls for standardized digital twin solutions.

Extent of modification scope needed on existing infrastructure to accommodate tie-backs is important for viability of new tie-in prospects. Swift modification and hook-up are important also for production efficiency of the existing production. Ability to choose subsea processing technology may ease topside modification scope, reduce cost and project execution time and thereby enhance overall economy of such projects. Several subsea processing technologies matured to project ready level is hence needed to capitalize on these opportunities.

For long tie-back distances, multiphase flow technology development competes with subsea processing and unmanned installations to provide the best development solution for a given prospect. Use of unmanned installations, floating or fixed, will increase the ability to process well stream to transport quality. Using existing infrastructure onshore as well as offshore for further processing can prove cost efficient. Further development of unmanned systems needed to improve brownfield as well as open greenfield opportunities is essential to harvest the full potential and define the NCS petroleum future.